In June, the Federal Reserve Board and the Federal Reserve Bank of New York co-hosted the Inaugural Conference on the International Role of the US Dollar. Federal Reserve Chairman Jerome Powell’s opening remarks emphasized the importance of the US dollar as the world’s dominant global reserve currency and the Fed’s commitment to price stabilization.

Powell touched on the importance of the US dollar to the global economy for things like stability and liquidity, but also to the US domestic economy, where much work needs to be done to reduce the rising rate of inflation and costs for the average American consumer.

During the second panel of the conference, speakers focused on digital assets. In particular, they examined the role central bank digital currency (CBDC) would play if introduced in the US.

Conversations surrounding these funds have shifted significantly from “if” to “when” and “how,” after President Biden’s EO released earlier this year offered a clear directive to better understand how to implement CBDC in the US.

A press release from the Fed stated that “the panelists [on the digital asset panel] they generally agree that technology alone would not lead to drastic changes in the global currency ecosystem, as other factors such as rule of law, stability, network effects and market depth are key to the advantages of dominant currencies.

“The current landscape for digital assets is more focused on retail investors for speculative purposes, and movement towards institutional investors is limited by the lack of regulatory framework.

CBDC development has also tended to be focused on domestic retail sectors and therefore does not pose a threat to the US dollar’s international status, with the scope of cross-border CBDCs still being quite limited.

The panelists expressed no material threats to the dollar’s international role arising from digital assets in the short term, and suggested that digital assets could actually strengthen these roles in the medium term if new sets of services structured around these assets are linked to the dollar.”

The Central African Republic promotes blockchain

In April, the Central African Republic (CAR) became the second country to formally recognize Bitcoin (BTC) as a form of legal tender.

This CAR decision is preceded by El Salvador, which became the first country to adopt BTC as legal tender back in September 2021. In an effort to keep the digitization momentum going in the country, CAR President Faustin-Archange Touadéra announced the start of the Sango project.

The vision of the chairman of the Sango project is to build a “common cryptocurrency and an integrated capital market that could stimulate trade and sustain growth”, advertising the future of digital transformation in the country by “launching a blockchain infrastructure project designed to modernize and raise the economy using the latest and most innovative technologies”.

The Sango project website either teases or discusses several other initiatives, two of which are called CryptoCity and CryptoIsland. At the heart of the project is SANGO Coin, which they describe as unlocking the following benefits for users of the asset.

First, it is citizenship, which will allow people to “join the digital transformation of the Central African Republic today. Both local and the first Citizenship Program in the Metaverse: a future of endless possibilities awaits you”.

Second, it offers the purchase of land in the physical world with a correlated one-to-one representation in the metaverse. Finally is e-residency, which is described as “both local and the first e-residency program in the metaverse. We welcome crypto enthusiasts to the digital oasis of the future and enjoy 0% crypto tax.

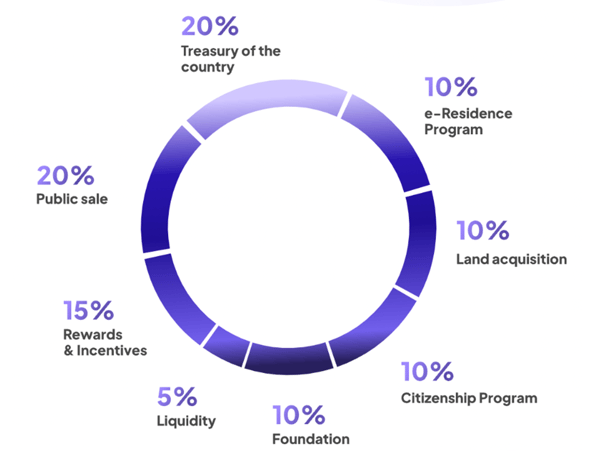

According to the website, the distribution of SANGO coins will go to the following areas and will be distributed by the end of 2022:

MAS considers retail crypto restrictions

The Monetary Authority of Singapore (MAS) – Singapore’s foremost financial regulatory agency – is reportedly considering placing further restrictions on the ability of retail investors to trade cryptocurrencies.

Responding to concerns about these potential restrictions, MAS Chairman Murali Pillai stated: “MAS has carefully considered the introduction of additional consumer protection measures.

This may include setting limits on retail participation and rules on the use of leverage in cryptocurrency transactions. Given the borderless nature of the cryptocurrency market, there is a need for regulatory coordination and cooperation at the global level. These issues are discussed in various international standard-setting bodies in which MAS actively participates.”

“MAS reiterates its warning: cryptocurrencies are very risky and not suitable for retail. People can lose most of the money they invested, or more if they borrow to buy cryptocurrencies.” The regulator has gradually increased its rules and regulations for cryptoassets and their service providers in the country.

The Bank of England calls for stronger regulation of cryptocurrencies

Speaking of global calls for increased restrictions and regulation on digital assets, the Bank of England’s Financial Policy Committee has given its own signals for stronger regulation amid current crypto-asset prices and market volatility.

To be fair, the committee acknowledged that cryptoassets do not currently pose a significant risk to the broader financial system. However, it adds that these tools may do so in the future as they become more widely accepted and ubiquitous.

In the Bank of England’s Quarterly Financial Stability Report, they note the recent increase in cryptocurrency volatility saying “Cryptoasset valuations have fallen sharply, exposing a number of vulnerabilities in cryptoasset markets, but not posing a risk to financial stability as a whole.

Taking into account downside risks from additional supply shocks, faster-than-expected monetary policy tightening and slower-than-expected economic growth, risk asset prices remain vulnerable to further sharp adjustments.

Amid high volatility, liquidity conditions worsened even in normally highly liquid markets such as US Treasuries, swaps and interest rate futures. The UK’s core financial markets remained functional, with participants able to execute trades, albeit at a higher cost. However, conditions could continue to deteriorate, especially if market volatility increases further.”

As for stablecoins, the report states “some stablecoins held for use in payments may not offer similar protections to central bank or commercial bank money.

In the UK, the FPC has set out its expectation that stablecoins used as money-like instruments in systemic payment chains – including those used for payments for financial assets and financial market instruments – should meet standards equivalent to commercial bank money in relation to stability of the value, robustness of the legal claim and the possibility of redemption at par in fiat”.

Once again, the Bank of England – like the Monetary Authority of Singapore (MAS) – is calling for greater overall regulatory fences for the crypto-asset market.

Metaverse Regulation Compliance