Financial planning It revolves around creating a stable future.

Traditional financing is no longer the only way to build wealth, but instead it evolved to include new classes, such as Coded.

With the height of Bitcoin, ethereum and other stablecoins, knowing how to manage your money is vital.

Crypto offers incredible benefits for a variety of investment portfolio, but also provides some unique risks.

Without having a financial plan and financial knowledge, you can make a victim Joint financial planning errors.

Your resource for encryption and news security

Keep awareness Bitcoin material, Your reliable source Crypting news, financial education, and self -friction tools. Whether you are new in Bitcoin or building a long -term wealth, we help you in more intelligent investment and stay protected.

Explore the blog

índice de contenidos

The 10 best errors in common financial planning

From excessive spending and the lack of budget to poor diversification and tax purchase, to you the The most common financial planning errors It may be made and how to correct it.

1⃣ Excessive spending

When your income rises, it is natural that you want to upgrade your lifestyle.

But if you lack a strong financial basis, this behavior may lead to major problems.

Lifestyle

When your salary increases, you spend on short -lived or modern purchases.

The Rolex watch or a luxury trip should not be; It can be a pleasant NFT or the super -flying memecoin.

During the 2021 Crypto Bull Run race, like distinctive symbols Dokwin and Sheba Eno He had huge (but temporary) gains.

Investors who bought SHIB in 2021 near its peak lost more than 80 % of their value within a year.

Who bought Shayb again in 2021 and still holds? … even if you are still upside down?

Byu/SERISD_WEAKNESS211 INSHIB

Instead, building Emergency Fund Or buy bitcoin while a decline will be a more intelligent financial step.

Bitcoin (BTC) Closed 105,472.41 dollars (15-06-2025)It is reflected +263.8 % increase Since 2021, the last price has been standing in 106,945.86 dollars.

Lifestyle for re -investment

With income growth, you have two options: Spend more or Reintegration.

The useful strategy is to reduce lifestyles to more than one 20 % From any increase in income.

residual 80 % It can be re -directed to savings, emergency funds, or long -term investments such as encryption funds or BTC.

This helps to increase your wealth over time.

To protect your long -term encryption investments, use safe storage solutions like Bitcoin.

The material resistant cold wallet maintains your entirely protected digital assets, air, not connected to the Internet, and under your will.

2⃣skipating budget and financial plan

The budget is financial planning 101.

Without a clear plan, it is easy to overlook or invest too much or neglect debts.

The encryption investors also need a budget

Good budget helps you stay in Control during the market and bull marketsand Avoid making emotional decisionsAnd Building a consistent plan For long -term growth.

https://www.youtube.com/watch?

Try to break your budget as follows:

🟢 Fixed costs (rent, bills, groceries): 50 %

🟡 Craft investment: 15 %

🔵 Emergency boxes: 10 %

🟠 Fun / Entertainment spending: 15 %

🔴 Debt payments: 10 %

This division helps you a balance between daily needs with long -term encryption targets, without going abroad.

3⃣ You do not have an emergency box

The emergency box is your safety net.

Without it, you may have to enter debt or even sell encryption and other investments.

Many experts recommend providing basic expenses from at least 3 to 6 months in a low -risk liquid account.

This protects your investments and gives you peace of mind during unexpected events.

Where do you keep it? Fiat versus encryption

There are some smart places to keep your emergency box.

| option | Positives | cons |

|---|---|---|

| Bank account | Safe, insured FDIC, can be accessed immediately | Low or non -interest |

| High -yield savings | Better interest, safe as well | It may take 1-2 days to be transferred |

| Stablecoins (rope) | It can gain interest, ideal for original cryptocurrencies | The risk of discrimination, is not insured like banks |

4⃣ Credit abuse, leverage, and debt

In the United States, many believe that credit is not a big problem.

Some even see it as “Free money“.

This cannot be further than the truth!

Do not confuse credit with the capital

Use Credit for investment In encryption it is super Risky Move.

Suppose you receive $ 3,000 to a 20 % credit card in April to purchase ETHEREUM while bull operating.

If the price decreases by 40 %, you will lose $ 1,200 on your investment, and you still have a full interest of $ 3000.

This does not mean that ETH will not wear in the long run, but if you depend on a quick return to pay your debts, you may be lucky and in a big problem if your prediction is incorrect.

Debt

If you are sitting on the gains, think about using a small part to get rid of high -interest debts.

For example, using a portion of your Altcoin’s profits to pay a 20 % credit card “returns” more than sticking to this origin on the market down.

5⃣ Ignore retirement and wealth planning in the long run

Some depend on their weekly salaries to get, while others add to 401K.

But did you know that there is more you can do?

Work and encryption together

The more you start investing in the early, the more it benefits from The growth of the boat.

until Small investments grow dramatically Over time when investing regularly.

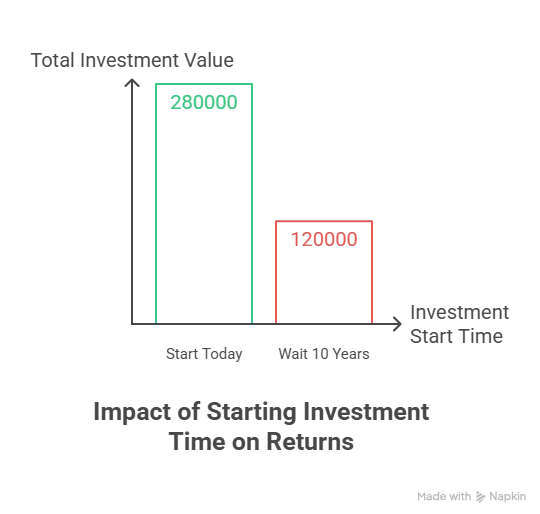

For exampleIf you start today to invest $ 200 per month with an annual return of 8 %, over 30 years, you will have more than $ 280,000.

Approval, if you wait 10 years to start, this total will decrease to $ 120,000.

This works for both of them Fiat and Encryption Investments.

the The key is starting And do not wait to provide a large amount for purchase.

6⃣ Lack of diversification and emotional investment

We have all heard the term “Don’t lay your eggs in one basket”, but you also don’t want to buy any coin on the market.

You need to conduct your search and be selective.

Not everyone goes in one currency

Diversity in various sectors and assets can help reduce risks.

A simple various encryption portfolio may include:

| Asset type | example | Customization ( %) |

|---|---|---|

| Bitcoin (store of value) | BTC | 40 % |

| Ethereum (smart contracts) | Eth | 30 % |

| Defi codes | AAVE, Uni, Companies | 10 % |

| Stablecoins | USDC, USDT | 10 % |

| Other (layer 1s, NFTS, etc.) | Sol, AFAX, Matic | 10 % |

If you are a beginner in Crypto, it may be to start investing only in Bitcoin and Ethereum is a better option.

These coins work historically well and give you the ability to test and get used to the encryption market before jumping to the most complex NFTS world of encryption projects, and other encryption projects.

Panic

The encryption market is famous for being volatile, but history indicates that it usually recovers.

The sale of panic during retreat often leads to greater losses that can be avoided with patience and planning.

View this post on Instagram

7⃣ Not to re -balance or review your plan

Your financial plan must develop in your life.

Not reviewing it is one of the most ignored things Joint financial planning errors.

Review it every three months and after major changes in your life, such as a new job, the market disruption, marriage, birth of a child, or great purchase.

Balance portfolio

Regular re -balance maintains your choice risk.

8⃣ Reducing real estate insurance and planning

If you have great dependents or assets, the insurance is a useful option.

A Life insurance policy It helps to make sure that your family will not suffer from financial pressure if something happens to you.

This can include payment of capital gains or inheritance taxes once you pass.

If you have built a strong encryption wallet, you need a plan to protect and transfer it.

Real Estate Planning: Protecting digital assets

The encryption is unique because there is No banks or Organizing recovery systems In the place if something happens to you.

Without clear instructions, coding assets can be lost forever.

✅ List of verification of simple real estate planning for encryption

| 📝 | Create a will that includes your encryption holdings. |

| 🔐 | Use the password manager to safely store portfolio accreditation data. |

| 👤 | Name a reliable person as a beneficiary or a backup holder. |

| 📦 | Maintaining seed phrases and recovery instructions in a safe place. |

9⃣ overlooking taxes and hidden costs

Many people do not realize that every trade is a taxable event, until it replaces one symbol for another.

In the United States, Tax Authority And other tax authorities treat encryption as property, meaning Capital gain taxes Submit an application or circulation of one of the assets.

‼ ️example: If you switch ETH for Sol, this is the sale of ETH. If you gained value since you bought it, you are a debtor for profit tax.

📊 The short term for long -term capital gains (United States)

| Decade | Tax | almost. an average |

|---|---|---|

| Less than a year | Short -term capital gains | It is subject to tax as an ordinary income (10-37 %) |

| More than one year | Long -term capital gains | 0 %, 15 %, or 20 %, depending on income |

advice: Check out our global encryption tax guide to learn more about how to maintain its compliance while keeping your assets safe in cold storage.

🔟 Ignore your feelings and behavior

Emotions can even destroy the best investment strategies and plans.

FOMO feelings, panic, and losing losing will lead you to poor timing and impulsive decisions, especially when encryption decreases quickly.

You can use simple tricks such as average cost in dollars, stick to a long -term plan, and only invest what you can bear.

Store your encryption safely in a non -friendly wallet like Bitcoin It will also reduce the desire to respond emotionally, while maintaining your focus on long -term goals.

Building more intelligent habits for success in the long run

Financial planning is no less important than encryption, as is the case in any other form of investment.

to avoid Joint financial planning errors Such as excessive spending, budget skipping, tax obligations, or emotionally investment, the difference between your success and your fall can occur.

Start small, keep steady, and your encryption fever with Bitcoin.