Building a safety network means creating a file Emergency Fund.

This is a sides of money specifically to cover unexpected expenses.

You cannot think about it as an investment or the goal of saving to spend a vacation, but it is a Financial insulating This prevents you from going to debt.

This post is exactly collapsing How to start your emergency boxEven if your budget is narrow.

You will learn the amount you need, the place to keep your money, and how Memorize more intelligent Based on your income level.

Are you looking for tips and tools worthy of confidence?

Visit Bitcoin For expert visions, cold governor, the latest news about investing in encryption and self -reinforcement.

Material

índice de contenidos

What is the emergency box and why do you need one in 2025

There are many major life events that require a kind of events Emergency Fund lay aside.

Job’s loss

Central bills

🔧🏠💥car/home repairs

How much do you really need: 3, 6 or 12 months?

Decision on the ideal emergency fund is not an accurate science.

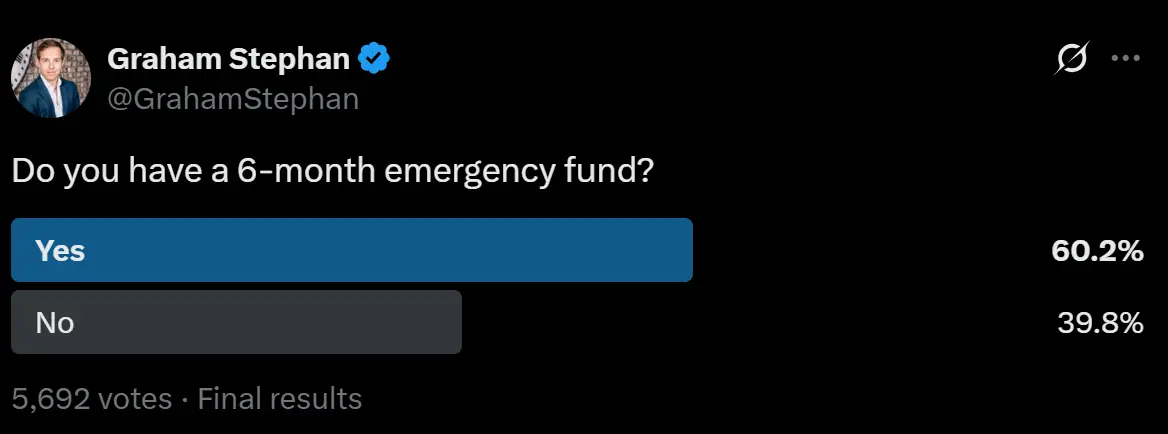

This depends on your situation, although most financial experts agree that the minimum 6 months It must be Standard Standard.

| Your profile | Recommended Emergency Fund |

|---|---|

| Persons, rental | Target 3 months From living expenses (rent, facilities, grocery) |

| The family with a mortgage | 6 months It is safer, covers children’s care, insurance and housing |

| Jobs for your own account or highly dangerous jobs | It is considered 12 months For the temporary store against income fluctuations |

Did you know?❓

According to Pankrate’s emergency savings surveying in January 2024, 56 % of Americans were unable to withstand emergency expenses of $ 1,000 Of their savings. 😬

Step -step guide to start your emergency box from scratch

One of the first steps is Open the savings account in allocated emergencies.

You might think, why do I need a new and separate account? Can I not know the amount I set aside?

no.

Keep your emergency boxes special Avoid “accidental” spending and Track your progress clearly.

Types of accounts: HYSA versus traditional savings

A HYSA savings account (HYSA) It is a type of savings account that earns More attention From one normal, often about 4-5 % In 2025, it is great to grow safely with your emergency box or short -term savings while keeping your money easily.

| Calculation | APY (United States) | Positives | cons |

|---|---|---|---|

| Hessa | About 3 % – 4.5 % | Higher attention, fadic secured savings | It may have the limits of transportation |

| Traditional savings | About 0.01 % | Wide access, easy to open | Almost no interest |

The best platforms in the United States and internationally

- ally: There are no monthly fees, strong APY

- wise: Currency accounts are multiple

- revolutionGlobal pockets, sub -hugs and encryption features

Start small and size

Once your account is prepared, you need to create a realistic goal.

💰Start with a modest goal of $ 100 to build momentum.

📱Use visual followers for help. Printable “thermal savings” applications can help you help you help you.

🗓Try a 52 -week challenge: Save $ 1 in the first week, $ 2 per week 2, … $ 52 per week 52. This will get a total of $ 1,378 by the end of the year!

Where do you make the discounts without sacrificing your style

🔍 Check your subscriptions

Stop or cancel unused services such as Netflix, Spotify or Litness Apps that you rarely use.

☕ Decrease the operation of daily coffee

Drink at home instead of buying coffee. Providing $ 3 per day adds more than $ 1,000 a year.

🍽 Reducing food delivery and eating abroad

Sweep meals or two meals per week for the alternatives cooked at home.

🚗 Review of transportation expenses

Use public transport, bike or cars as possible.

🛍 Know where your money goes

Use applications to track spending categories.

MooreMoneclips Simple Ways to save money #Money #ECONOMY #ENTREPRENEUR #TAX #BUUSINESS

Using stablecoins for emergency boxes

Since the encryption is seen as one of the very volatile assets, many of them move away from it as a means Savings for the Emergency Fund.

But can stablecoins be a useful backup?

| ✅ positives | ⚠ negatives |

|---|---|

|

|

For beginners, using a Hessa It is the safest.

But a small additional addition Stablecoin Reserve (5-10 % of the box) can give you flexibility.

Usdt materials

Tether ERC-20/EVM

$ 89

How to build your emergency box based on your income level

Whether you are winning a smaller or much amount, there are always smart strategies and investment to suit your situation.

Savings on a lower income

Saving money when you earn a small income can feel impossible.

The key is Start small and fixed.

- Use Micro Saving apps to guide you. Applications like Roll Collect any purchase to save spare parts, while Harmonious The application can automatically automatically a percentage of your salary.

- Finding ways to achieve additional income can provide your savings. Try freelanceing or perform strange functions.

- Set small and realistic goals. Save only $ 5 a day, but it quickly adds in your emergency box.

The goal is not to save millions immediately, but to make progress.

Even if you can only save a little, building the habit to save and not spending it puts you in a stronger position for the future.

Medium income range

When you make a decent amount, there are always ways to rearrange your money to save more.

- Find monthly bills to reduce (phone bills, subscriptions …)

- Use money recovery tools. Many banks and platforms offer small discounts on grocery stores, gas, or eating.

- Try Crypto Cashback to convert your daily spending into encryption bonuses.

High

Most people assume that earning a large income means that you can withstand any crisis that comes.

But in reality, there are always some surprises that may make you care.

- Use “accidental” income, such as tax recovered amounts, bonuses, or investment profits in encryption, to add them to your emergency box.

- Building a variety of wallets to earn more to rescue later.

- 40 % for your emergency box

- 30 % for debt payment

- 30 % for investment

The errors that should be avoided when starting your emergency box

The start of the emergency box is a smart step, but some errors can slow you down.

Here are some of the most common mistakes and how to avoid them:

1 ⃣ Keep it in cash or examination

You may think it is safe to keep emergency money in cash or your regular bank account, but both come with negatives:

| Storage method | Positives | cons |

|---|---|---|

| monetary | Immediate arrival | No interest, risk of loss or theft |

| Verification | Easy to use and track | No growth, it is very easy to spend by mistake |

| Hessa | About 4.5 % of APY, FDIC, safe | It may take 1-2 days to transfer money to verification |

advice: HYSA is usually the best place for emergency boxes. It is safe, gains interest, and keeps your money separate from daily spending.

🏦 If you are wary of traditional banking services, you will store part of your emergency box in Stablecoins A The decentralized alternative For your money.

This provides 24/7 Accessand Global movementAnd Free from banking restrictionsIt is of special value in countries with limited financial infrastructure.

2⃣ Mix your savings in emergency situations with daily spending funds

One of the biggest errors is to keep your savings in emergency situations in the same calculation of your daily money.

Without realizing this, you may be overwhelmed, especially “this time only.”

- Open a separate savings account in a different bank if you need it.

- Disably online transfers.

- Use titles such as “Do not touch” to reinforce the border mentally.

3 – Unrealistic goals

It can reach very quickly it can bring in reverse results.

Saving $ 1,000 per month is great and perhaps easy to achieve, but it is difficult to keep it if you are on a narrow budget.

- Start small: Try $ 100 a week or % of each salary.

- Build a savings habit, not spending.

View this post on Instagram

Tools and applications that make the provision of emergency easier

Round-UP and Auto-SAVE tools

- Use Qapitaland RollOr Monzo To collect purchases and save change

- Set the daily automatic waves

- Try

Budget applications that give priority to emergency funds

- Ynab (You need a budget): Set every dollar job, starting with your emergency box

- whateverIt follows spending and helps to give priority to savings goals

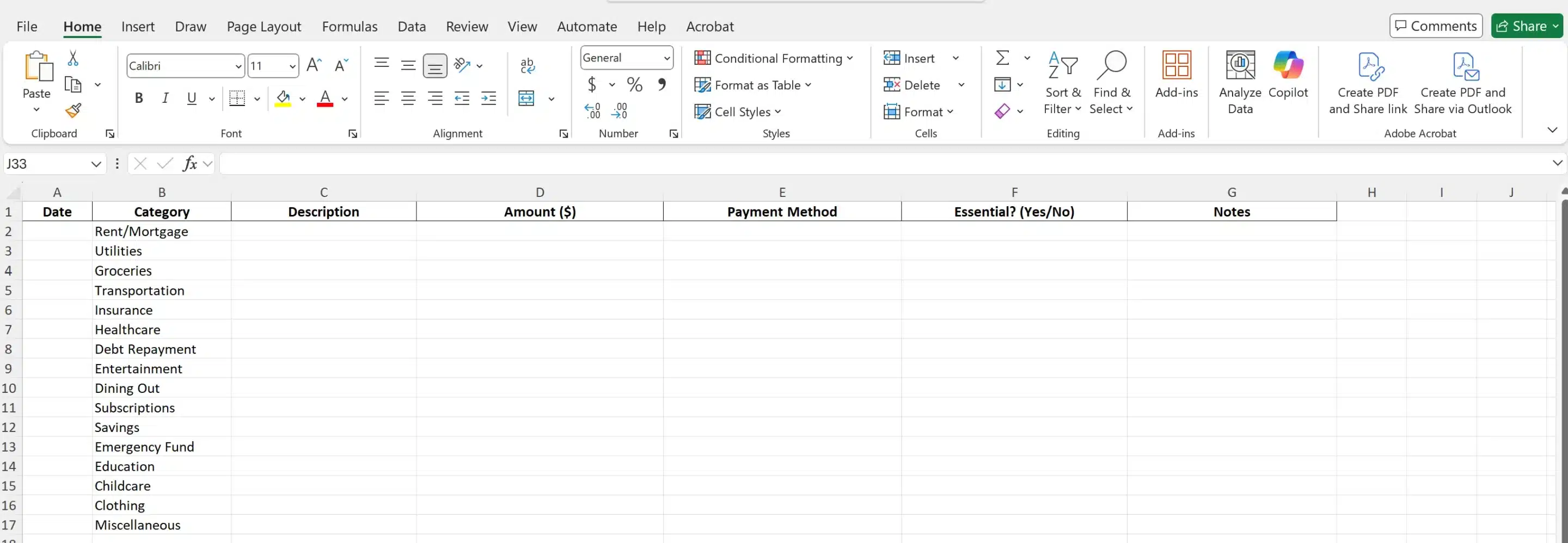

adviceYou do not need to spend money on luxury applications. Using an old Excel paper is good to prevent fixed expenses and follow your daily spending is a great place to start!

How do you know when the emergency box is “ready”

The health emergency fund takes time to grow.

Depending on the level of your income and fixed expenses, you set a specific goal for you Financial stability It will keep you on the right track and reach a realistic goal.

Once your Emergency Fund It is designed, it’s time to convert your focus into building your wealth.

You can start investing in encryption in a cold safe governor like BitcoinEstablish long -term investments, or work to enjoy a holiday.

Just rememberYour emergency box should be always available to any unexpected problem.

Common questions

How much should I save in my emergency box?

- Most experts recommend 3 to 6 months of basic expenses.

Where should I keep my emergency box?

- The perfect high -return savings account; It is safe, gets interest, keeps your money separate from daily spending.

Can I use the encryption of my emergency box?

- Yes, Stablecoins such as USDC can provide flexibility and access without banks, but it carries organizational risks and liquidity.

How do I start saving with low income?

- Start small with $ 1-5 a day using small confrontation applications or side vehicles. The consistency matters more than the amount.

[ad_2]