Knowing whether to share encryption or keep as an important investment strategy in 2025.

Since the encryption is adopted on a wider scale in the world, many investors are wondering whether investment will be for negative income or long -term growth.

Every approach has its rewards, risks … and tax effects!

In this guide, we will explain everything you should know about Stokeing Vs Holding Crypto in 2025.

We will compare potential returns, security risks, tax responsibilities, and any strategy is the best for you as an investor.

índice de contenidos

Stacking Vs Holding Crypto

Staking Vs Hold: What is the difference?

While they are both common methods of encryption management, they serve different goals and appeal to different types of investors.

How to work on the abyss proving networks

Staking is one of the most important proof of stories (POS).

the Ethereum blockchain Convert to this model, while Bitcoin The work proof system (POW) is used to verify the authenticity of transactions.

POW uses sophisticated miners, while POS relies on auditors who share encryption.

The Stoke Your Crypto’s comparison is that you win rewards, similar to the interest at the expense of traditional savings.

You do not need to be an expert to exchange encryption because most people use assembly bathrooms.

Whether you are using central platforms or Defi protocols, Staking is a encryption investment strategy used to create a negative income from encryption.

Examples of popular points of sale

Holding long -term encryption investors

Hodling is the philosophy of encryption for long -term investment.

This means that you buy the cryptocurrency that you intend to keep by ascending and falling on the market.

The goal is that the encryption assets will deserve much more in the future.

Traditionally, Hodles does not participate or actively circulate.

Instead, they focus on buying more and holding encryption assets safely, waiting for a long -term estimate.

Bitcoin It is a trusted material wallet designed to safely store Bitcoin without electronic parts, making it perfect for those who have a “purchase and processing” strategy.

How much can you earn? Comparison of returns and growth capabilities

When choosing between Stacking Vs Holding CryptoYou need to think about the potential return on investment.

Staking will give you regular payments, while the pressure estimate depends on the long -term encryption.

Typical yields through the platform and coin

Erotic rewards, also known as as Staking APY (Annual percentage), differs from Blockchain, audit performance, and whether you use a Central exchange Or a A central platform.

Average return

Central stock exchanges such as Binance and Corner Submit automatic vehicle bonuses, but Defi options usually return higher bonuses, especially when used Liquid liquid protocols.

But you have to understand that Do not guarantee the returns of attention It can fluctuate on the basis Network activity and Auditor’s performance.

Also advanced Risk Love Penalties or Smart contract.

Estimate price for long -term holders

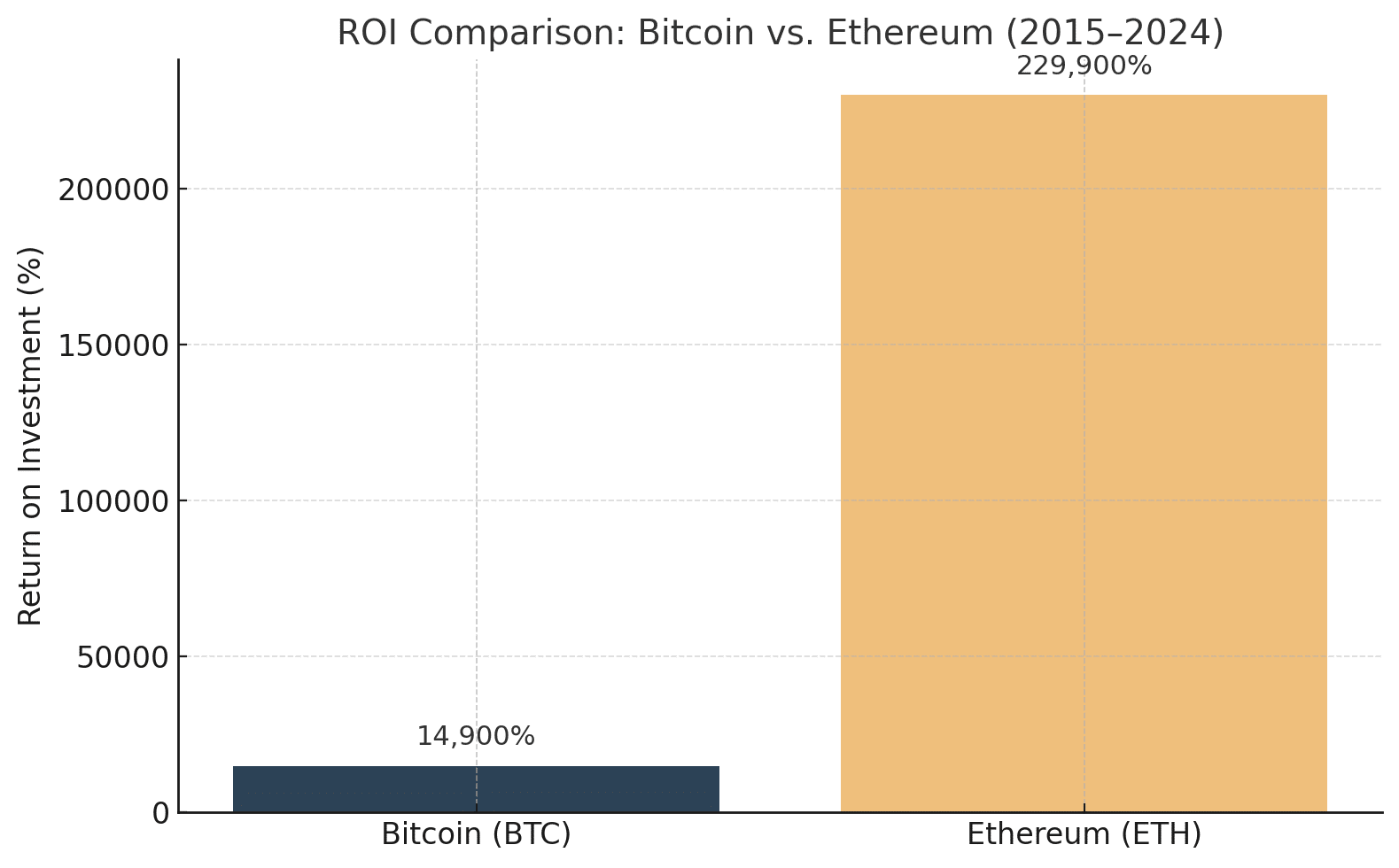

Long -term encoding often benefits the main price gains over time, especially when it comes to Bitcoin and Ethereum.

Historical performance (2015-2024)

What are the risks of exhaustion in exchange for retaining encryption?

Either their risks, but their knowledge can help you make more intelligent decisions to protect yourself.

Risk

- The loss of penalties is one of the most common risks. This happens when the auditor you use or wanders is in a non -communication mode, causing a part of the stunning encryption to be lost.

- Smart contracts that are used in Defi Staking can be vulnerable to deception.

- Central platforms manage their own risks due to piracy.

- Irrigation investors raise their encryption without knowing expectations and what it requires.

Fortunately, there are some regulations that are implemented, as in the United Kingdom, to protect Stakers.

A safe reference list:

✅ Choose auditors or good reputable platforms

✅ Use liquid liquid protocols with audit operations

✅ Do not subscribe to all of your possessions

✅ Understanding unstable lock and delay periods

Risk

- Expression means that you are coming out of the market, which can be difficult during bear markets or price fluctuations.

Liquidity: Can you access the encryption at any time?

The extent of access to your encryption depends on whether you are giving up or holding, and it can make a big difference when the markets move quickly.

Some deception requires your encryption lock.

For example, at ethereum stokeing is an amazing delay for several days, called Associated.

with LiquidYou can get a symbol symbol representing your amazing encryption, so that you can trade or use it even while earning the rewards.

Instead, if you are holding the encryption, especially in an unlocked wallet like BitcoinYou can reach it at any time.

No imprisonment, no waiting times.

How are taxes affected by coding in exchange for retaining encryption?

In the United States, the off -tax department treats and adheres to completely differently.

Erotic tax responsibilities

Tax taxes are imposed as income when received, and not when sold.

For example, if you earn Crypto at a value of $ 500 of Stokeing in 2025, you will condemn the income tax on this amount.

- Many platforms are emitting model 1099 to report your entry into the Tax Authority.

- Even if you do not sell rewards, they are still taxed at the moment you earn.

- Later, if you sell amazing metal currencies for profit, you may also condemn the capital of capital gains (tax duplication).

Tax advantages of long -term contract strategies

If you simply carry the encryption for at least 12 months, any profits of the sale are long -term capital gains.

Tax is imposed at a rate less: 0 %, 15 %, or 20 %, depending on your income.

- No income has been reported during your contract; You are subject to tax only when selling.

- Using a cold wallet helps you track encryption holdings.

Which is better for you?

The best approach always depends on your goals, carrying risks, and financial priorities, such as whether you should pay debts before investing at all.

Negative profit

If you are looking for fixed returns and like the idea of earning bonuses while waiting, wealth is a good option for you.

Hodler

If you believe in long -term growth of assets like Bitcoin or ethereum (Which has been historically proven) and does not mind waiting by ascending and landing in the market, reservation is a better choice.

Combing both strategies

The good news is, you do not have to choose one or another.

Many investors use a hybrid model.

For example, hold 70 % in BTC and support 30 % in ETH for negative income.

Just be sure to think about your life stage, risks, and whether you may need liquidity.

And if you carry high -interest debts, it may be wise to pay this first before locking the money in encryption.

What do experts say?

Many experts depend on platforms such as Eigenlayer, which allow the recovery: walking the same encryption through multiple protocols for the higher returns.

On the other hand, many analysts still preach run, especially for Bitcoin.

Some even argue that smoke has been completed Bachelor’s.

For many investors, the balanced approach can provide the best in the worlds.

Just make sure that your encryption strategy suits your financial priorities, and the encryption protection is always used using a reliable encryption wallet to avoid risks.

Common questions

Is Stank encryption better than keeping it?

- Attention can generate regular rewards, while reservation is historically showing that it results in long -term gains. It depends on your investment goals.

Can I lose money by attention?

- Yes. The risks include reduced penalties, checkered errors and smart contract errors, especially in Defi.

Do I pay taxes to encrypted Stock?

- Yes. Tax taxes are imposed as income when received, even if they are not sold.

Is the encryption contract safer?

- In general, yes, especially when stored in a cold wallet.

Can I do both?

- definitely. Many investors participate in part of their portfolio to get income while keeping the rest for long -term growth.

[ad_2]