Low purchase, high sale It is one of the most famous principles of investment.

It is a simple theory, but it may be difficult to implement in practice.

The strategy includes a decline in a decline Bitcoin Fols and sale When it is Rising.

The goal is to profit from market fluctuations.

This guide collapses how “”Bitcoin high sale, low purchase“It works, expert merchants use, and common mistakes to avoid them.

| Step | What does it mean | Why do it matter |

|---|---|---|

| 1. Low purchase | Buy bitcoin when the price is less than average or decline. | It helps to increase gains when prices are recovering. |

| 2. Holding | Keep Bitcoin in a safe storage while waiting for the market to rise. | The original is allowed to value the value over time. |

| 3. High sale | Sell when Bitcoin reaches a much higher price. | Locks in profit and benefit from the low primary purchase price. |

índice de contenidos

The basic principles of bitcoin high sale, and I buy low

Bitcoin high bitcoin strategy has been applied to many different commercial assets.

It is a common strategy, but since the Bitcoin market is very volatile, it needs a lot of attention to real profit.

BouvImagine that you bought Bitcoin 1 at $ 20,000, then sold it later when the price reached $ 30,000. Your profit was $ 10,000, 50 % yield.

This is the perfect scenario, but capturing these price movements in the actual time is rarely clear and easy to achieve.

The encryption market is famously volatile, which can provide many opportunities for low purchase, and high sale, but it can also expose you to a rapid and unexpected decrease in the market.

Many experts in the encryption trade agree that the timing of the market is difficult.

Yes, there are many strategies and bitcoin analysis tools to use, but what you need first Your goal.

View this post on Instagram

As a pioneer for extreme cold storage solutions, Bitcoin He is committed to helping you understand bitcoin trading and protect encryption gains once the trade is completed.

Our experience in Bitcoin space showed this Equalization of profits is no less important than making. Long -term safety and strategy are essential parts of the trading equation.

Psychology is behind the timing of the market

Take advantage of the “high -sale bitcoin and low purchase” strategy not only related to plans and price points.

It is also related to overcoming human psychology.

Emotions, like Fomo (Fear of loss) and PanicThey are the real threats that can cause merchants to buy when the prices are at their peak and sell them during corrections.

This is the opposite of what this strategy is.

What can you do to overcome emotional purchase and sale

| ✅ Strategy | 📘 The purpose |

|---|---|

| Using limit orders | Avoid excessive payment during price mutations and stick to your purchase goals. |

| You have a plan | Set clear goals to sell parts of your property and lock gains. |

| Stay on, not emotional | Follow reliable news; Avoid the decisions driven by noise (selling Fomo or panic). |

| Use cold storage to maintain long term | Keep the long -term encryption and less selling. |

How to use technical indicators

⚠ DisintegrationThe following section explores the indicators of technical analysis used at the time of Bitcoin work. These tools require moderate and advanced knowledge to read Bitcoin chart and must be used with caution, especially by beginners.

Using RSI tools

RSI is a tool that shows the speed and change of the price of the original. This is what the merchants show if the original is more than his arm or excessive work.

📊 Signs of buying and selling RSI

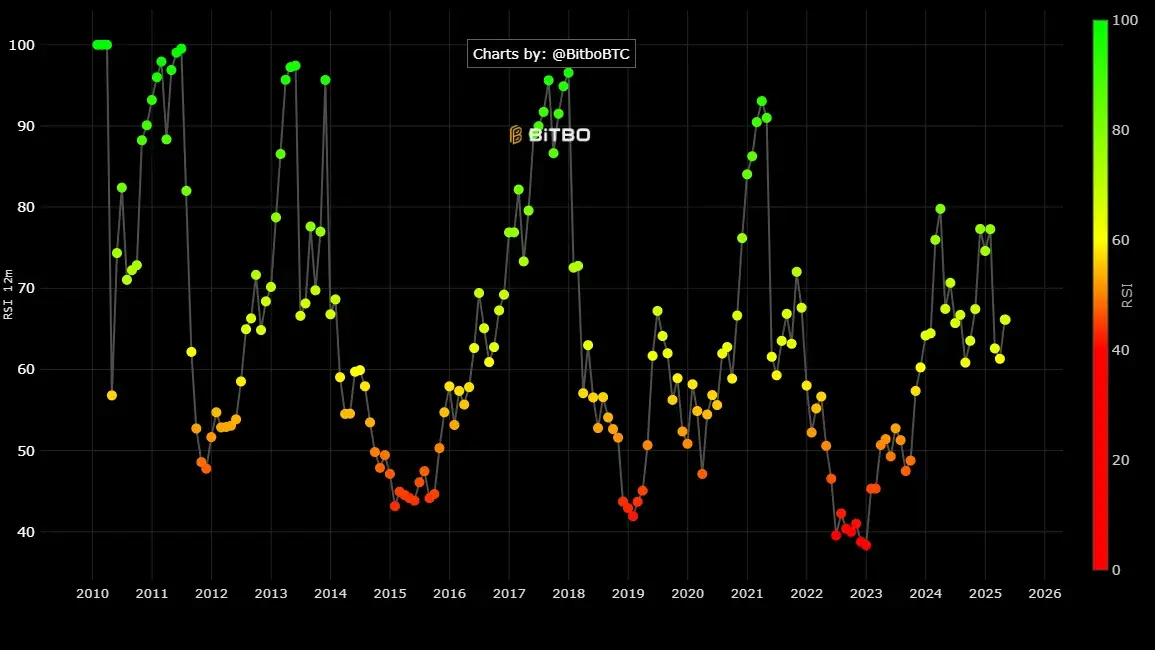

the Relative power index (RSI) It ranges from 0 to 100 It is used to determine possible entry and exit points.

- 🔴 RSI above 70: It may be bitcoin Its purchase: maybe He sells signal.

- 🟢 RSI less than 30: It may be bitcoin Overost: maybe He buys signal.

Case Study: April 2025

In April 2025, the Bitcoin relative index rose above 70. This means that the original was in his arrest.

At almost the same time, the Bitcoin price reached a height of about $ 96,910 before returning to about $ 94.207 by the end of the month.

This correction is in line with RSI predictions: When the index exceeds 70, a short -term price decline usually follows.

The trader who realized this sign should have made profits before the decline.

Macd implementation

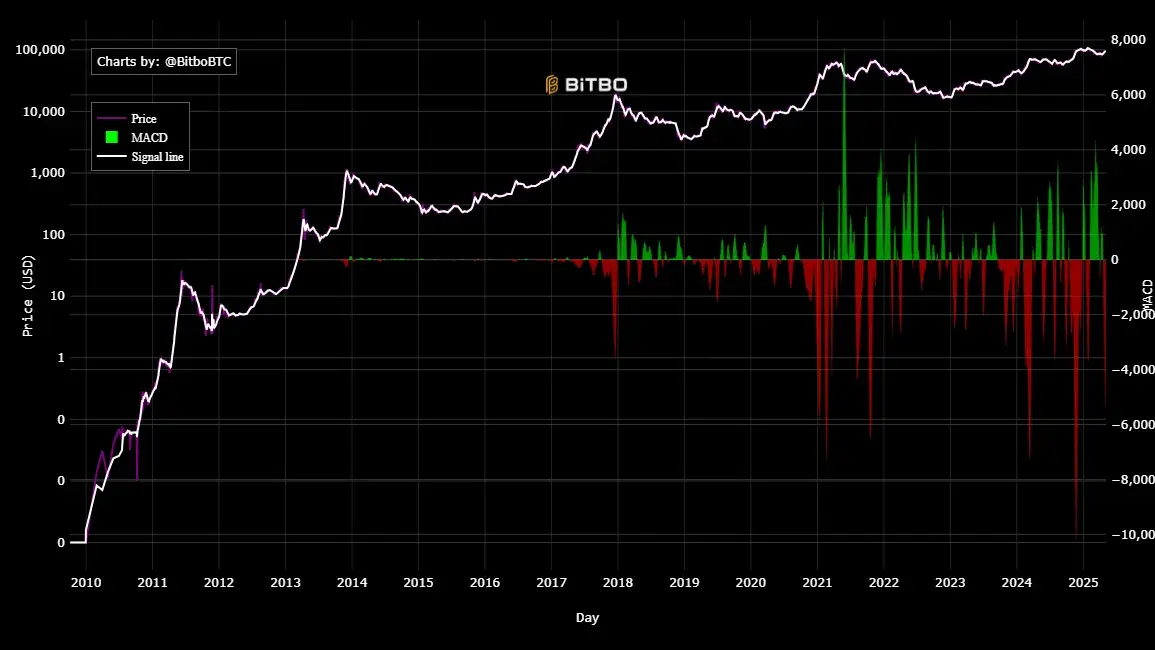

MACD (moving average rapprochement) is another common technical tool that offers momentum changes and possible repercussions of the direction.

Discover momentum transformations

the MACD Index It helps in determining the possible direction repercussions by analyzing the moving averages.

- 🔹 MACD line: 12 days EMA minus EMA 26 days

- 🔹 Signal line: EMA for 9 days of MACD

- 🟢 Al -Soulali intersection: Macd crosses above Signal line: possible He buys signal

- 🔴 Landing Cross: Macd crosses less Signal line: possible He sells signal

Case Study: April 2025

In mid -April 2025, the Bitcoin Mac Index was showing an upper intersection.

This happens when the MACD line moves over the signal line, indicating a possible increase in prices.

After this reference, Bitcoin rose from about $ 83,415 on April 5 to about 97,000 dollars by May 2, an increase of 16.29 %.

This type of jump has occurred before, after MACD transitions.

MACD is useful for trend tracking strategies and is often used with RSI.

Transfer averages in determining market trends

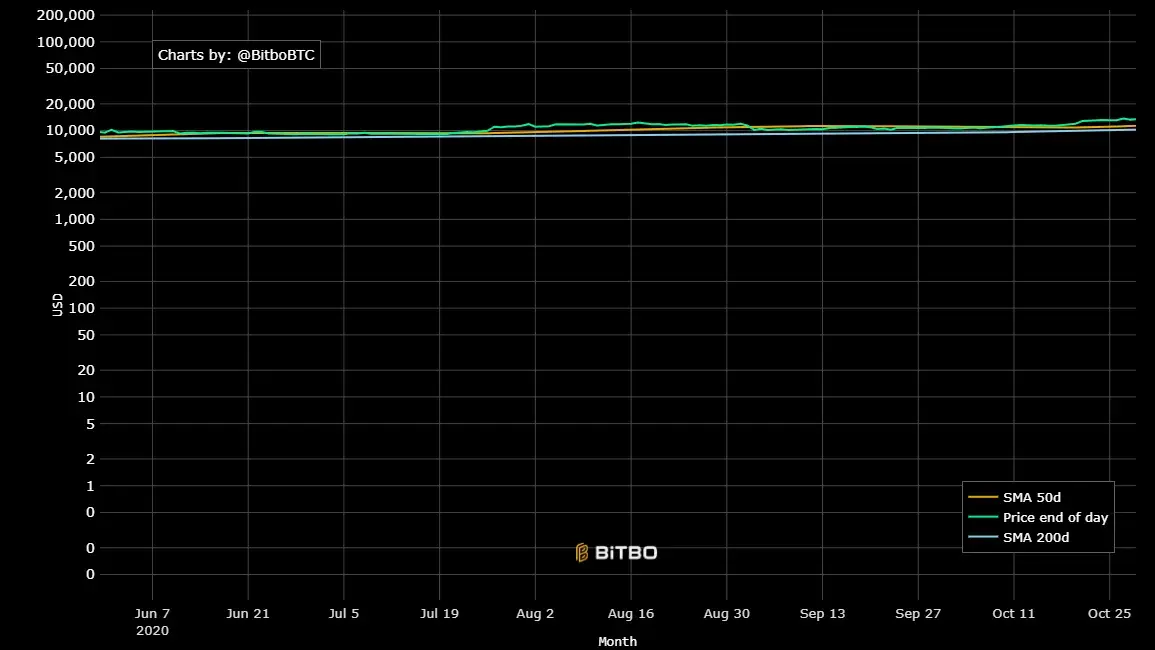

Mediterranean transmission (MAS) helps price “smooth” price data to discover long -term and short -term trends.

📊 Moving averages

The two most common types of moving averages are:

- 📘 Simple moving average (SMA): It gives equal weight All price data.

- 📘 EMA: EMA: It gives more importance to The last prices.

Includes popular time frames 50 daysand 100 daysAnd 200 days Moving averages.

- 🟢 Golden Cross: 50 days m above 200 days MA: Often a The upward trend.

- 🔴 The Cross of Death: 50 days m less 200 days MA: Often a The declining direction.

Case Study: MA Golden Cross

In August 2020, MA from Bitcoin crossed 50 days over MA 200 days, and formed a golden cross about $ 9,500.

This event came directly before the long bull race that rose Bitcoin to more than 67,000 by April 2021.

The use of these indicators does not guarantee success, but it can improve your chances of making more intelligent decisions, especially when using them with strong risk management and understanding market conditions.

Tools and platforms for effective circulation

Once you know the strategies that must be placed in place, there are some useful tools that you can benefit from to help you achieve your Bitcoin investment strategy.

Suggested drawing platforms for technical analysis

Effective technical analysis is crucial for successful bitcoin circulation.

There are many platforms available:

| tool | Features | Best for |

|---|---|---|

| Tradingvief | Certified charts, technical indicators, community text programs and actual time data | Traders who want flexibility and careful drawing |

| Coinigy | Integrated and planned trading through many stock exchanges | Multi -opposition merchants looking for all tools in one |

| Kraken Pro | Data in actual time, safe environment, and professional drawing tools | Advanced merchants who want to implement rapid and safety |

| Bitcoin | Bitcoin technical analysis updates every two weeks, specially designed for long -term holders using cold storage | Bitcoin investors focused on security and strategic timing |

These platforms will help you in the tools needed to analyze market trends, determine trading opportunities and manage risk effectively.

Robots and AI trading

Artificial Intelligence Trading Robots are tools for buying and selling encryption automatically for you using algorithms and live market data.

Emotions are supposed to take from trading and make faster decisions and data based.

But it is not perfect.

Their ability depends on the accuracy of artificial intelligence, the data it uses, and what is happening in the market.

They can also make mistakes in fast -changing conditions and may pose security risks if they are not safely prepared.

For this reason it is important to test it first, monitor how they do, and not to rely on it alone to manage your trading.

| Advantages ✅ | Risks ⚠ |

|---|---|

| It works 24/7 without human fatigue | The interpretation of changes in the sudden market may be offended |

| Traders are carried out faster than manual methods | Trained artificial intelligence models can badly lead to losses |

| Remove Emotional bias Of decisions | The objectives of electronic and extraordinary attacks |

| Large quantities of market data can be analyzed quickly | It still needs human supervision and control of the strategy |

Resources for learning and community participation

Inclusion in societies and the use of educational resources can enhance trading skills and knowledge:

| Resources | a description |

|---|---|

| P/encrypted currency and R/bitcoinbeginns |

Reddit active forums for market discussions, novice advice, and actual time encryption visions. |

| Books and courses | Bitcoin mastery by Andreas M. Antonoboulos Online educational programs provide great starting points for Blockchain education. |

| Bitcoin Blog materials | It covers the security of bitcoin, the governor, trends, and educational lessons. It was updated with 3 articles written experts every week. |

Risk management in the volatile bitcoin market

1 ⃣ Set effective offspring levels for profit

- Use stops to reduce losses and profit orders to pick up gains.

2⃣ Diversification strategies to spread risk

- Spread your investments through different assets and strategies such as trading in the pleasure, and time frames such as Purchase It is useful, but looking at both the BUYS The Cold amount and DCA.

3⃣ Disturbance

- Before entering the trade, you must choose the amount of money to be invested carefully, based on the amount you want to lose if a trade error occurs.

🔒 Regardless of your strategy, always provide profits in cold storage.

Bitcoin Provides the best place to store your Bitcoin.

A safe and simple way to keep the bitcoin in a non -communication mode, protect it from breakthroughs and the failure of exchange.

Common questions

Is “Bitcoin High Selling, low purchase” for beginners?

- It is a simple idea, but it may be difficult to implement for everyone. Beginners should start small and use tools to help.

How does market conditions affect this strategy?

- The volatile market provides more opportunities but also higher risks. In quiet markets, price fluctuations are usually very small so that they cannot be profitable.

Could this approach be effective?

- Yes, with commercial robots or artificial intelligence platforms, but they need accurate preparation and continuous monitoring.