In 2025 in 2025, a long -term encryption investment has become one of the most strategic methods of encryption.

After the half of Bitcoin in April 2024, historical trends indicate the encryption bull round.

Along with global inflation and economic certainty, investors move more towards decentralized assets as a Hedging against traditional markets.

To the extent that even institutions adopt encryption.

Main organizations, such as Blackrockand SincerityAnd JpmorganIncrease its exposure to Bitcoin and Ethereum through the investment funds circulating in Al -Fawiya and other distinctive symbol platforms.

Some experts even claim that S & P 500 Dead and that encryption is the only market in which it is investing.

All this indicates the purchase and celebration strategy.

Whether you are new to encryption or have been investing from the first day, and determining The best encrypted currency for purchase and contract It is the key to building your digital wallet.

índice de contenidos

What makes the encrypted currency deserve to keep in the long run?

There are more than 21,000 symbols of trading as of 2025, but less than 500 of them have a daily trading volume of more than a million dollars, according to what he said. Coinmarketcap.

What this means is that the vast majority of cryptocurrencies fail to have a long -term strength.

To know the symbols you deserve to invest in, you must evaluate the main basics before buying:

| 📊 Evaluation criteria | Why do it matter |

|---|---|

| Market value | Large coins like Bitcoin (BTC) and ETHEREUM (ETH) Provide more stability. Distinctive symbols with small clouds may grow faster but have a higher risk. |

| Developer | strong Jaytab Activity, repeated obligations, and DEV sharing usually indicates the health of the project. An example Bolkadot, Solana, and Ethereum. |

| Security and consensus | Pow (Bitcoin) is very safe. Post (ethereum Post-MERGE) provides expansion. Hybrid models combine the benefits of both. |

| Liquidity and size | High size lists and exchange means the easiest entry/exit. |

| Society and decentralization | Projects like Bitcoin and ethereum It has flourished thanks to the non -central world societies, not only the founding teams. |

What affects the long -term value

The long -term value of the cryptocurrency is greatly affected by using the real world and its design.

| ✅ The review menu component | 🔍 Interpretation |

|---|---|

| Collective accreditation | The value of the distinctive symbol grows with widespread use. ethereum It leads the Defi and NFT sectors, with more 40 billion dollars TVL In early 2025. |

| Distinguished symbol | Bitcoin It has 21 million users. BNB Hollowed symbols to reduce the width. Ethereum EIP-1559 burns graphics, making ETH (about 0.2 % inflation). |

| Feasibility | Symbols with cases of use in the real world, such as Eth, Sol, Link, IMX, Sand, A, Fil, The value and dependence on the long term are likely to gain. |

Red flags to avoid it

It may be very exciting to get to know new projects and try to achieve a rapid transformation on memecoin.

But it is important to discover warning signs before investing.

👤There is no team that can be determinedAnonymous or non -active teams usually indicate a lack of accountability or long -term vision of the project.

💸Symbolic inflation or no supply coverProjects that do not show clear control elements in inflation or inflation have a risk of reducing the value of symbols over time.

📈The noise moves without a real useMetal currencies that are heading to social media or pumps groups, but lack operating products or partnerships are often short -term. There are endless examples of mimokins that are heading and disappear.

🐋Low liquidity and central ownership: If there is a small number of governor that keeps most of the supply, then the project is subject to manipulation and what is referred to as “rug withdrawn”.

🔒 Forescent safety audits or no audit at all: It is a project that has not passed a security security of an external authority as a major cause of concern. You can use tools such as CERTIK or Hacken to review the audit results.

The highest encrypted currencies to buy and keep them in 2025

Before buying any encryption, always looting (Do your own search).

The cryptocurrency is very sophisticated and rapidly developed assets.

There is no investment without danger, so take time to understand the basics of encryption, market conditions, and what are your financial goals.

Learn and secure your encryption

in BitcoinWe are more than just reliable cool storage solutions; We are your resource to identify encryption, compare portfolio, and manage your long -term investments with maximum safety.

With this in mind, here are some of The best encrypted currency to buy and keep itBased on benefit, adoption and long -term capabilities:

1⃣ bitcoin (btc)

It is often called Digital goldBitcoin is the most famous and widely dependent cryptocurrency.

The institutional interest continues to grow, with Blackrockand SincerityAnd ashen Providing or managing the investment funds circulated in Bitcoin.

Its fixed supplies of 21 million coins and very safe proof of work (POW) makes it a value for long -term encryption.

Just look at Kevin Olieri, Nickname The master is wonderfulAdvice for 2025.

Kevinolerytv if you are wondering about where I see the biggest encryption opportunities, here is my focus: 1⃣ bitcoin – digital gold. He said enough. 2⃣ ethereum – operation of the smart contract revolution. 3⃣ Stablecoins – Use USDC for transactions because it is effective and reliable. Of course, I support Wonderfi, the stock exchange that makes all this smooth in Canada. #CryPtoinvesting #Wonderfi #ETHEREUM SOUND

2⃣ ethereum (eth)

ETHEREUM is OG of decentralized applications.

With its move to prove a class, ETH now offers revenues (with an average of about 4 % APY).

This is very attractive for long -term holders.

Make burning transactions via EIP-1559 ETH.

This translates into eth becomes a scarcity, and thus Valuable.

3⃣ Solna (Sol)

Solana has a strong bounce since the FTX repercussions.

Its high -speed transaction speeds (65000 TPS) and low fees make it one of the best platforms for Defi and NFTS.

The growth of the ecological system has expanded to include Solana Mobile and Firedancer, a second auditor who is expected to increase speed and reliability.

As of 2025, Solana is the top 10 currency by market solutions, with the development of active VC.

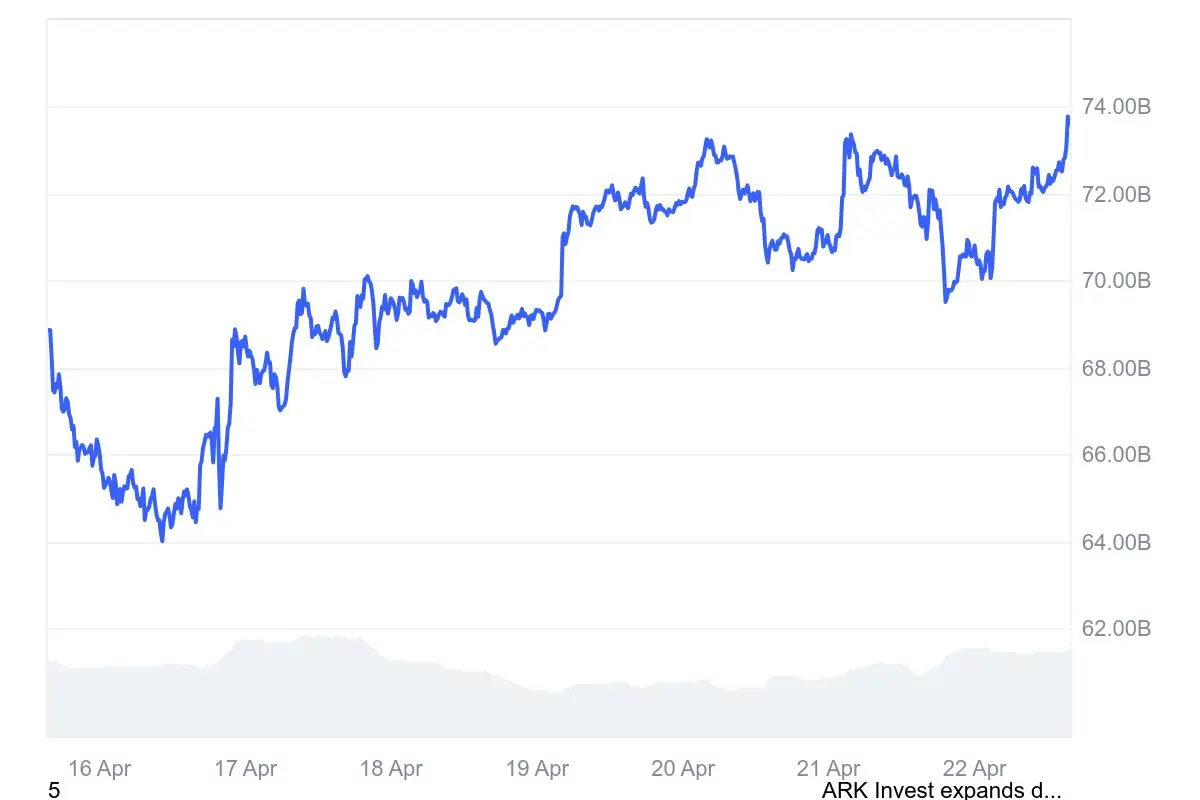

Solana Market Market

4⃣ chainlink (link)

ChainLink is an Oracle Top solution to connect smart contracts to real data.

They have major partnerships with Google Cloud, Swift and many other Defi platforms.

5⃣ Irbia (arb) or optimism (OP)

Expression and optimism account for more than 60 % of L2 ethereum TVL As of 2025.

The main DAPPS such as uniswap, AAVE and GMX runs on these lists, providing faster and cheapest transactions.

| code | Why is it interesting |

|---|---|

| Matic polygon | Ethereum scaling solution with low fees and institution partners like Nikeand I respondedAnd Starbucks. |

| APTOS (APT) | Built on Move Programming language, designed for safe and developed smart contracts. |

| Avalanche (Avax) | It supports custom sub -networks and gets a preposition for the distinctive code of institutional class. |

| Kaspa (kas) | Use Blockdag To extract rapid prisoners (second blocks); Wonderful for high -speed applications. |

How to match the right encryption with your profile

Just as an investor is not the same with their goals or risks, no codes.

Whether you are trying to understand whether the encryption is a bubble or you are serious about building a Long -term encryption planChoosing the right assets is the key to investment and smart trading.

Here’s how to choose the right cryptocurrencies based on your investment style:

Conservative holders

If your goal is to maintain wealth with low risk, it is better to adhere to large and well -established cryptocurrencies like Bitcoin and ethereum.

focus on stability and The maximum market.

These assets are less volatile and have a high trading volume.

It is also supported by large societies and have an institutional interest.

It is more suitable for long -term nodes.

🚀 Investors focus on growth

If you are looking for higher capabilities and you are comfortable with more risks, you should explore newer projects in fast -growing sectors.

Look at projects like Solana, Irvi, APTOS, and a body.

These projects participate in Gamesand Amnesty InternationalAnd Decentralized infrastructureAnd therefore you have the greater possibility to make gains, but it can be more volatile!

⚖ Various strategy

A balanced portfolio, in our opinion, is the smartest approach.

As beginners, Bitcoin will not fail in the long run.

Once you create your encryption feet, try to diversify in different categories such as 1s (ETHEREUM, Solaman), layer 2 (definition, optimism), and chainlink.

Store your long -term encryption investments

Your encryption secures is no less important than choosing the coins that must be invested.

As a long -term pregnant woman, finding the best place for the encryption contract will help protect your assets from breakfast, exchange failure or accidental loss.

The best nodes in the long term (cold versus hot)

Cold portfolios are the safest option.

Some of the best governors of the available devices are a cold portfolio, such as Bitcoin materials, Professor’s bookand TrezourAnd Bow.

Hot wallets, like metamask and Portfolio confidenceIt is good for rapid trade technologies, such as trading in pleading, but it is not recommended to store large amounts of long -term encryption.

| The main area | ✅ What to consider | 📌 Tips and tools |

|---|---|---|

| 📊 Tracking and re -balance |

|

|

| 💼 Taxes and compliance |

|

|

| 🔐 Store the cold wallet |

|

|

Common questions

Is it better to hold some large metal currencies or diversification?

- It depends on the endurance of risk. Big currencies such as BTC and ETH provide stability, while diversification can reduce risks and increase potential growth.

How long should I carry before the sale?

- Many long -term investors keep at least 4 years or through full market courses. Your schedule should match your financial goals.

What is the safest way to long -term encryption?

- Use a cold portfolio like Bitcoin Mateial and take off a seed reserve in a non -contact mode to cold backup governor such as Mateial DIY. Avoid leaving large sums on the stock exchanges.

[ad_2]