With the launch of blockchain monitoring for Zcash and Horizen on the Elliptic platform, we explain why the risk associated with these assets is actually lower than often assumed, and how regulated financial institutions can now safely support this important cryptoasset class.

Blockchain tracking solutions provide regulated financial institutions with the ability to determine the source or destination of funds when handling a crypto-asset such as bitcoin. This enables them to provide their clients with access to these assets and to comply with their anti-money laundering and sanctions obligations.

These solutions rely on the fact that crypto transactions are recorded in a public ledger, known as the blockchain. At Elliptic, we combine blockchain information with proprietary data to provide financial institutions with blockchain monitoring solutions that follow the trail of money and enable them to scrutinize crypto transactions for links to illegal activity.

Dealing with mixer compliance risks

But sometimes cryptoasset users don’t want their transactions to be traceable on the blockchain. This may be because they are involved in criminal activities that they wish to remain hidden from law enforcement. But it is more likely that they simply want to maintain their financial privacy and autonomy – necessary features of an open society.

When using bitcoin, one way to achieve improved privacy is to use a “mixer”. Mixers are online services that allow their users to pool their cryptoassets, before returning the amount deposited to each contributor (minus fees). It is important that the specific “coins” received are different from those deposited in the pool – breaking the transaction trail.

For a crypto exchange compliance professional, this poses a problem, if the ultimate source of funds cannot be determined because a mixer was used, how do they know if a customer’s bitcoin deposit came from a dark market, a ransomware wallet, or a legitimate source?

Well, for starters, the blockchain tracking solution has already provided useful information – that the incoming funds originated from the mixer and that the blockchain should not be tracked beyond that. This is a critical insight that helps guide the next steps – usually further analysis of the customer’s activity, which may include looking for evidence of their ultimate source of funds – similar to the types of checks that might be applied to a bank customer who makes a large cash deposit. Users using mixers may also be subject to lower transaction limits and higher levels of identity verification.

Crypto exchanges have developed sophisticated processes that allow them to deal with the use of mixers by their customers and distinguish money launderers from those who simply seek financial privacy.

———–

In the same way that a cash deposit in a bank is not automatically considered proceeds of crime, neither are cryptoasset transactions from mixers – the wider context of the transaction and the customer are taken into account to decide whether further action is required.

———–

Solutions such as Elliptic Navigator allow exchanges to assign risk scores to transactions involving mixers, based on factors such as the value of assets going into or out of those mixers, the exchange’s own risk appetite, or specific guidelines from their regulator.

Privacy Coins – Mixing is included as a feature

Which brings us to privacy coins. These cryptoassets also allow users to avoid leaving a transaction trail on the blockchain, but they achieve this in a different way. They achieve improved privacy by embedding hashing-type functions directly into transactions, rather than through an external hashing service, as is the case with fully transparent assets such as bitcoin.

The first class of privacy coins is private by default. This includes monero, which seeks to hide the details of all transactions. It is unlikely that there will ever be blockchain monitoring tools that allow compliance professionals to track monero transactions – if such a possibility existed, it would defeat the point of such a tool.

Another class of privacy coins are those that have opt-in privacy. These include Zcash (ZEC) and Horizen (ZEN), which allow users to choose whether or not to make their transactions visible on the blockchain. The vast majority of transactions that take place in these currencies look the same as bitcoin transactions – they are fully visible on the blockchain, and blockchain monitoring tools such as Elliptic can be used to track the source and destination of funds and assess their risk.

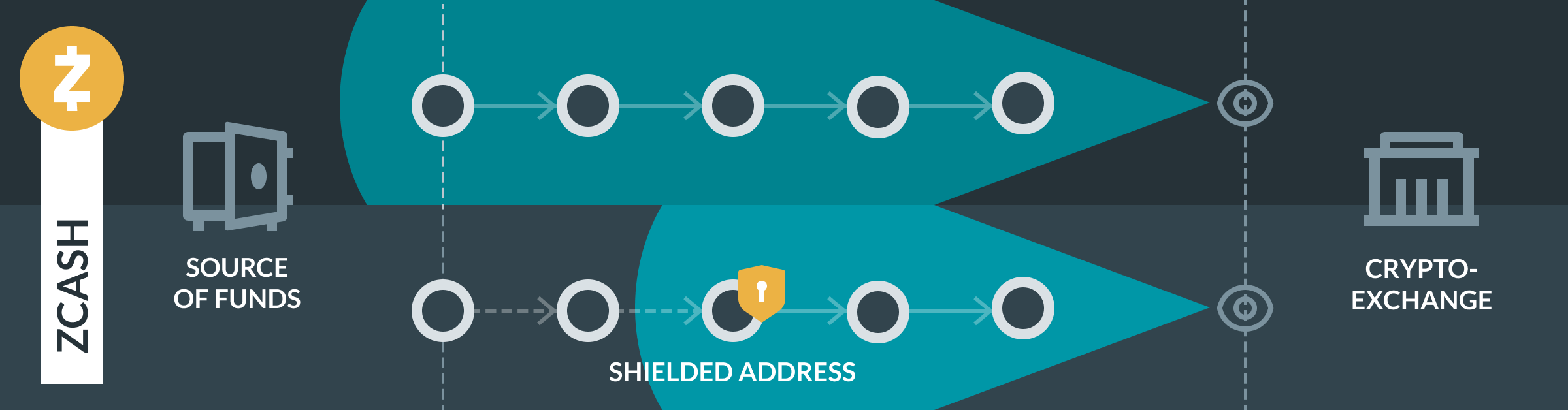

However, users of these currencies also have the option of sending funds through “protected” addresses. These addresses do not appear on the blockchain, and blockchain surveillance cannot be used to trace funds through them. Sound familiar? These secure wallets accomplish much the same thing as mixers – but this functionality is built into the currency itself.

What this shows is that if regulated businesses such as exchanges have managed to manage the risk posed by their customers’ use of bitcoin and mixers, then the same can be achieved for their use of privacy coins such as Zcash and Horizen.

If blockchain monitoring indicates that a Zcash deposit ultimately originated from a secure wallet, then as with funds from a bitcoin mixer, the funds cannot be traced further. But in either case, the exchange can still use solutions like Elliptic to assign risk ratings to transactions that reflect its risk appetite. And in either case, the exchange’s compliance analyst can then use the same processes to assess the risk of this client’s transaction and determine next steps.

Criminal adoption

So blockchain tracking privacy coins that have opt-in privacy features allows risk to be handled in the same way as bitcoin. Compliance professionals can also take solace in the relatively low criminal use of many of these assets.

Elliptic’s intelligence analysts are constantly monitoring how the cryptoassets supported by our platform are being used, scouring the Dark Web for evidence of their use by criminal actors. To date, we have observed very little adoption of Zcash or ZEN by illegal entities. Bitcoin remains the crypto-asset of choice for criminals, due to the ease with which it can be acquired and converted back into fiat currency. These findings echo those of a recent RAND report, which found no evidence of widespread illegal use of Zcash.

Re-evaluating privacy coins for inclusion

Regulators and policymakers tend to lump all privacy coins together when considering the financial crime risks they pose. However, the combination of blockchain’s traceability and the low level of perceived criminal adoption means that the risks associated with privacy coins such as Zcash and Horizen are likely even lower than for similar bitcoins. By combining blockchain monitoring and proven compliance controls, businesses and financial institutions can now safely and reliably support this important cryptoasset class.

Genesis, an industry pioneer and leader in digital currency trading and lending, will use Elliptic’s transaction and wallet monitoring solutions to detect and prevent illegal activity in Zcash and ZEN. See the press release for more details.

Sanctions Compliance Articles