The wait is over. Yesterday the Financial Action Task Force (FATF) published its long-awaited report describing the conclusions of its 12-month review which assessed the progress made by countries and the private sector in implementation instructions on virtual assets. Exchanges and other Virtual Asset Service Providers (VASPs) were eager to hear the FATF’s ruling, particularly its ruling on the industry’s progress in implementation Travel rule.

The full report is essential reading for any AML compliance professional, but in the meantime I’ve teamed up with the Elliptic Global Policy and Research Group (GPRG) to bring you three key takeaways from the report.

1. VASPs must be launched in order to comply with FATF’s extended deadline for AML/CFT regulation.

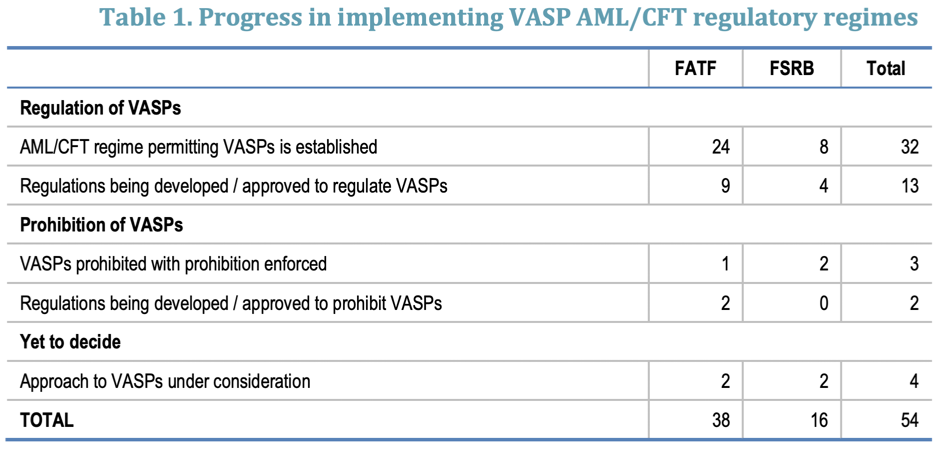

According to the FATF report, 32 jurisdictions it investigated have imposed anti-money laundering and countering the financing of terrorism (AML/CFT) regulations in the virtual assets sector. While this represents more than half of the 54 countries that volunteered for FATF’s survey, the report states that most countries around the world have still not implemented FATF standards and that “a significant amount of work remains to be done”. The report highlights that these ongoing regulatory failures threaten to undermine the FATF’s efforts to ensure the integrity of the international financial sector.

The FATF decided to continue reviewing countries’ progress for another year, until June 2021, when all jurisdictions “will have two years to transpose the revised FATF standards on VASPs into law.” So while countries may have a bit more room to implement FATF’s standards, FATF will be watching closely and expects to have the job done by this time next year.

VASPs should not interpret this lag in the implementation of FATF standards at the country level as a sign that they can avoid it conformity with BPPN/BPFT standards. With the FATF watching closely, more and more countries will undoubtedly impose regulation on this sector over the coming year.

VASPs should take proactive steps to meet high AML/CFT standards now, wherever they operate.

2. FATF expects VASPs to implement technology-enabled solutions to meet the requirements of the Travel Rules, or otherwise.

When the FATF adopted its Virtual Asset Guidelines in June 2019, a frequent question that still plagued many in the industry and even the public sector was whether it would ever be possible to develop travel rule solutions that could meet the FATF’s expectations -a. .

FATF has now definitively answered that question.

According to the report, the FATF is encouraged by “advances in the development of technological solutions to enable the implementation of travel rules”, even if the solutions are still widely adopted and some practical implementation challenges stay. In particular, it notes important advances in the developing industry common standards for travel policy messagingand “urges the VASP sector to redouble its efforts” to adopt technical solutions for global compliance.

The FATF report makes clear that it will not accept claims of technical impracticability as an excuse for non-compliance with the Travel Rules – and that it expects VASPs to implement solutions.

3. The FATF expects the industry to be globally compliant with the Travel Rules by June 2021, with no exceptions.

And just to underline its point, the FATF has drawn a clear line in the sand when it expects the industry to be able to comply. Pointing to June 2021, he notes that by then “the VASP sector will have had time to implement travel rule solutions globally.”

So here it is. By this time next year, the global standard setter for AML/CFT regulation expects VASPs everywhere to be able to demonstrate compliance with the Travel Rules.

Over the next few weeks, we’ll be examining the travel compliance implications for VASP in detail, including country-by-country developments, so stay tuned for exciting updates!

At Elliptic, we will continue to closely monitor FATF updates to provide our clients with the guidance and technology solutions they need to meet FATF AML/CFT requirements, including travel compliance. Watch this space!

Compliance with Financial Services Regulations