USTD, also known as pregnancyIt is considered one of the most widely used stablecoins.

Although it is a type of cryptocurrency, it is best considered as a separate category of cryptocurrencies.

Tether is a more reliable option, tying the cryptocurrency market to fiat currencies.

It is pegged to the US dollar on a 1:1 basis, which means you can trade and invest it like cryptocurrencies but without their volatility.

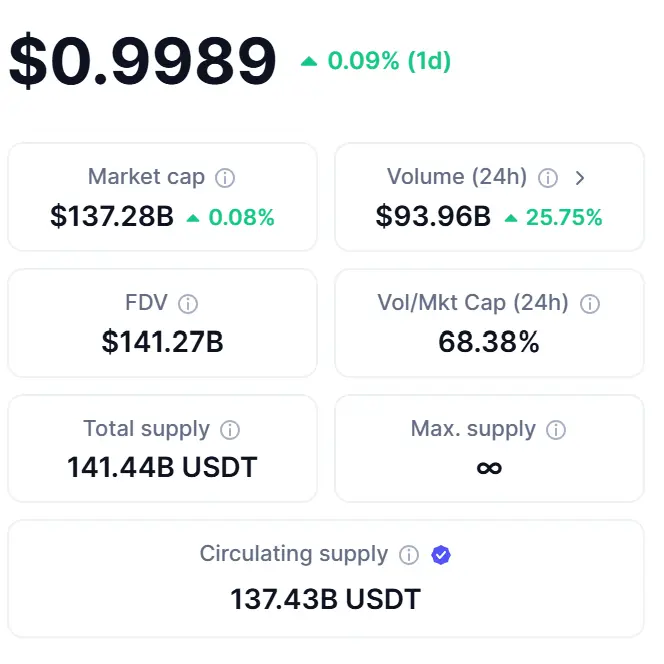

As of early 2025, Tether has reached an impressive level Market value: $137.28 billionThis makes it the most widely traded stablecoin on the market.

As new US government and global cryptocurrency regulations evolve, we wonder: Is Tether a good investment?

In this post, we will review Tether’s potential and analyze its future in terms of regulatory initiatives and how it compares to other stablecoins.

List of contents

Understanding Tether (USDT)

Tether is a stablecoin, a type of cryptocurrency designed to maintain the stable value of the fiat currency tied to it.

How does Tether work?

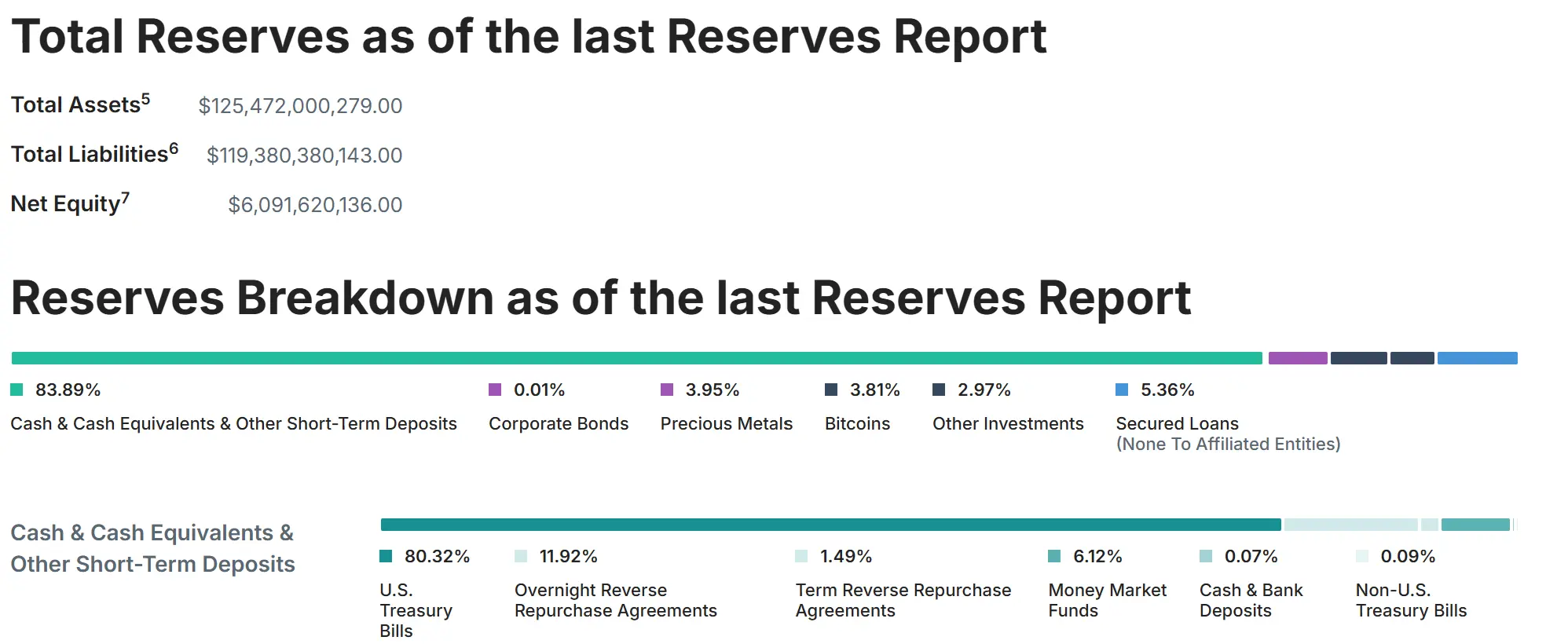

Unlike Bitcoin and other cryptocurrencies, stablecoins, such as USDT, maintain stability from their reserves.

These reserves consist of short-term deposits, U.S. Treasury bills, cash, and other assets.

This is a much-needed reassurance for investors, meaning that Tether offers high security and instant liquidity.

Aside from being a “safer” investment compared to other cryptocurrencies, Tether also offers almost instantaneous transfer capabilities and compatibility with major blockchain networks such as Ethereum, Solana, and Tron.

An important aspect to consider when buying and trading USDT is having a secure storage solution.

Just because Tether is tied to the US dollar does not mean you are protected from online hackers.

Moving large amounts of crypto assets to a cold storage wallet is vital to the safety of your investments.

USDT is a trusted cold wallet without any electronic components, which means it is unhackable and stores your private keys offline.

Purpose and common uses of USDT

Cryptocurrencies are known to experience extreme price fluctuations, making stablecoins like Tether a safer option.

USDT allows you to transfer funds across different cryptocurrency exchanges, usually with minimal transaction fees.

By holding USDT instead of fiat currencies, you can participate in owning cryptocurrencies while avoiding the price fluctuations associated with them.

Is Tether a good investment?

There are many attractive aspects to buying USDT.

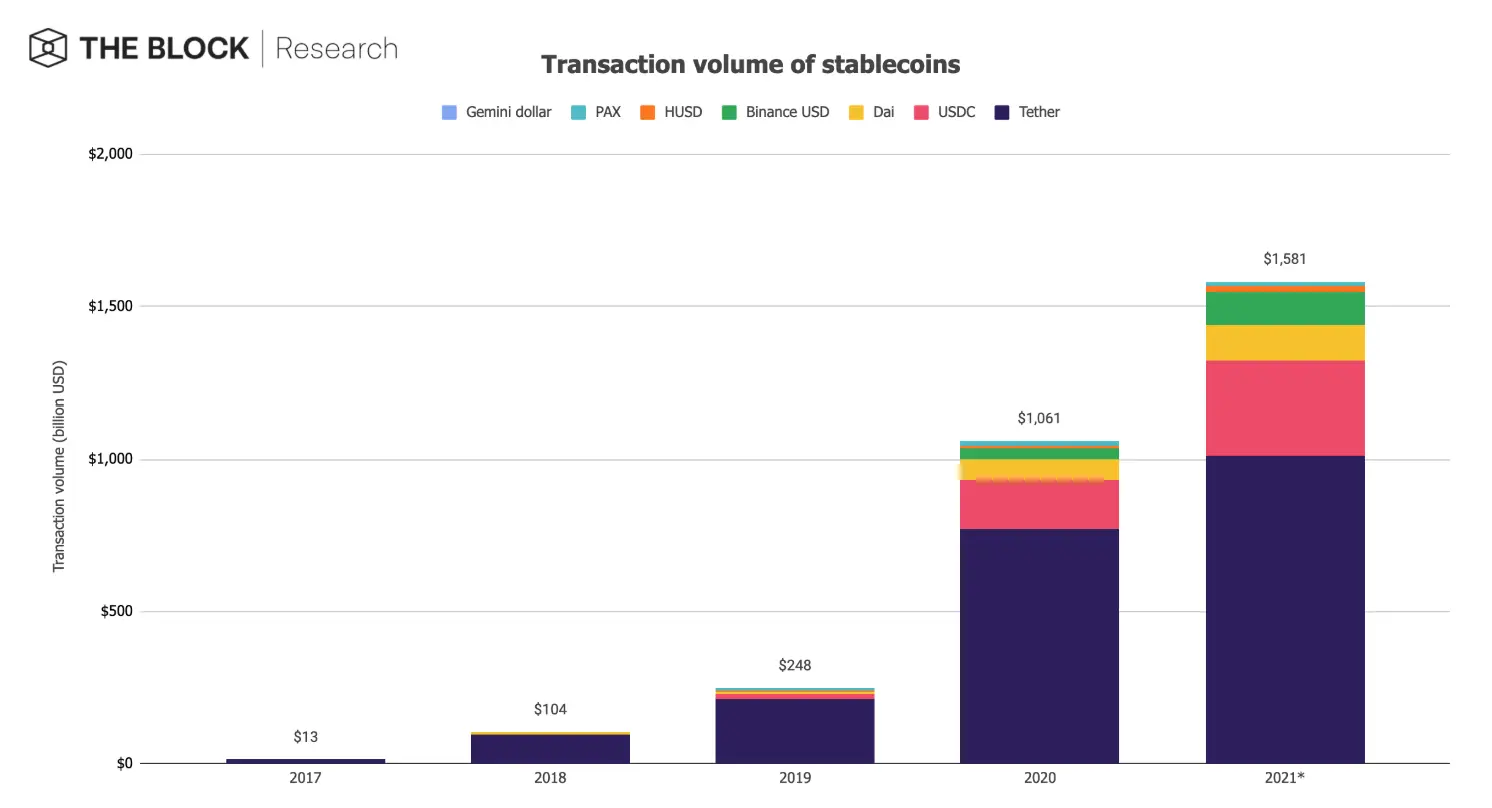

USDT has reached a high of over $1 trillion in terms of transaction volume, indicating its importance in the cryptocurrency market.

Determining why it’s a good option for your wallet comes down to a few key points:

- It offers stable returns with minimal risk.

- USDT is a hedge during market corrections as investors convert their assets into Tether until market conditions improve.

- It has high liquidity and accessibility: average daily trading volume exceeds $100 billion.

| How can Tether make money for you? | |

|---|---|

| Earn interest through staking or lending platforms |

|

| Arbitrage opportunities

Arbitrage is the buying and selling of the same assets in different markets at the same time to make a profit from small price differences. |

|

Is investing in Tether safe?

We must stress that no investment is ever foolproof, and we cannot guarantee that you will receive high returns on your investment.

But what we can say are the facts: Tether’s safety depends on maintaining its peg ratio US dollar.

As Tether says, its reserves are made of… monetary, US Treasury bondsand Other assetsThis is what maintains its stability and value.

But that doesn’t mean there hasn’t been some scrutiny of Tether and its so-called asset reserves.

Tether’s transparency regarding reserves

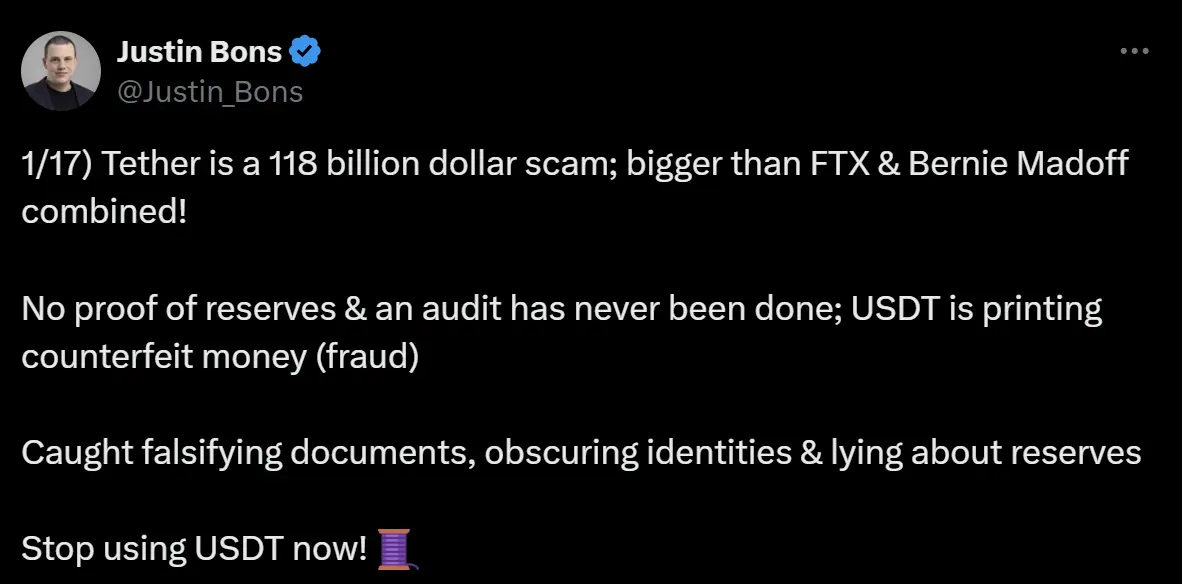

In 2021, the New York Attorney General investigated Tether resulting in a $41 million fine for misrepresenting its reserves.

At the same time, the CFTC issued filing charges against Tether Holdings Limited, Tether Limited, Tether Operations Limited, and Tether International Limited (d/b/a Tether) for “making untrue or misleading statements and omission of material facts.” Regarding the USDT Tether token stablecoin.

More recently, in 2024, Justin Bonesone of the world’s leading cryptocurrency specialists, has continued to issue warnings about Tether.

After facing issues with government agencies and regulatory pressures, Tether has taken big steps to become more transparent.

They publish quarterly reserve breakdowns for public review.

Cold storage wallets to secure USDT

One major potential complication of any cryptocurrency is the risks involved in cyberattacks.

There are many cryptocurrency exchange risks and vulnerabilities affecting cryptocurrency wallets, making the need for secure cold storage a priority.

Using USDT cold storage material

| benefit | |

|---|---|

| Offline security | ➡️Cold wallets keep your private keys offline, protecting them from potential hacking attempts and online attacks. |

| Protection against cyber threats | ➡️With over $3.8 billion lost to cyberattacks in 2023, storing USDT in a cold wallet helps protect you from these risks. |

| Permanent construction | ➡️The USDT material is made of stainless steel, making it fireproof, waterproof and resistant to physical damage. |

| Easy to use for beginners | ➡️USDT is designed for ease of use. It has clear instructions and requires no setup. It’s perfect for beginners. |

| Peace of mind | ➡️Ideal for long-term security of your USDT holdings. |

| Reliable backup | ➡️It provides a tangible, indestructible object to securely back up your private keys. |

Future predictions for Tether

Knowing or not Tether is a good investment It may sound complicated, but in reality, when you look at the facts, all theories seem to suggest that yes, it is a good investment.

It is the most dominant stablecoin on the market.

At the end of 2024, Tether was calculated 70% of the total market capitalization of stablecoins.

This makes it the most widely used and traded stablecoin globally.

Tether continues to grow with market demands, adding new features and support for other popular blockchains like Ethereum and Solana, and making the DeFi space more efficient.

Challenges and competitors

As USDT continues to grow and rise in the cryptocurrency market, so do its competitors.

Other stablecoins such as US dollar currency (USDC) and Central bank digital currencies CBDCs are becoming more popular with investors because they have stronger regulatory compliance and transparency.

As regulatory pressures increase, especially in the United States and Europe, more investors are looking for currencies that comply with these stricter regulations.

Good investment opportunities for USDT

Regardless of these challenges, Tether remains the leading stablecoin and is adapting to these new implications.

USDT is commonly used in many countries that have unstable fiat currencies, ensuring that these citizens hold value in some form of the US dollar.

It has also expanded into the DeFi ecosystem, making access to lending, borrowing, and liquidity pools easier.

Tether’s future growth potential

✅ It dominates the market by 70% in the stablecoin sector.

☑️ Blockchain support continues to expand.

✅ Increased usage in emerging economies.

☑️ Growth in DeFi applications.

⚠️ It faces competition from USDC and government-issued central bank currencies.

⚠️ Regulatory scrutiny remains a concern.

Final Thoughts: Is Tether a good investment for you?

You can’t say that Tether doesn’t provide some sort of security in the cryptocurrency space.

Maintaining a stable value helps investors and traders overcome market volatility and provides an easy way to participate in the DeFi space.

So, Is Tether a good investment?

The answer depends on your financial goals.

If you are looking for stability, liquidity, or a way to hedge against market downturns, then yes, it is a great option.

But we must point out that it is not designed for that Gains or Much appreciated Like traditional cryptocurrencies.

No matter your decisions about which cryptocurrencies to buy, just make sure you store them in one of the best offline cryptocurrency wallets like Physical wallets To give you peace of mind.

Frequently asked questions

What is a rope?

- Tether is a stablecoin pegged to the US dollar at a ratio of 1:1.

Is Tether a good investment?

- USDT is an ideal option if you are looking for stability, especially for investors who want to invest in cryptocurrencies without worrying about their volatility. Therefore, whether USDT is the right choice for you ultimately depends on your specific investment goals and priorities.

How does Tether maintain its peg to the dollar?

- Tether relies on reserves, such as cash and US Treasury bonds, to ensure its value remains fixed at $1. As a result, this support helps maintain its stability and reliability.

Is Tether safe to use?

- Tether is a popular stablecoin but concerns have been raised about reserve transparency and regulatory issues.

Can I store Tether offline?

- Yes, using a cold storage wallet like Material USDT is the most secure way to protect your USDT.