In the public debate about crypto-assets, their use in cryptocurrency money laundering, terrorist financing and other financial crimes is often mentioned. It is often anecdotal, sensationalized, and of little practical use to compliance officers at cryptoasset businesses and financial institutions, or to regulators and other governance, risk, and compliance professionals.

These discussions also fail to recognize how new innovations are positively transforming the cryptoasset space. For example, decentralized finance (DeFi), non-fungible tokens (NFT), stablecoins and other new aspects of the ecosystem provide alternative mechanisms for consumers to engage in cryptoassets. They are also driving the development of a “metaverse” – a growing, self-contained virtual ecosystem where the sale and purchase of goods, services and other complex social interactions can be facilitated by cryptoassets.

Moreover, these innovations have been met with corresponding developments in the traditional financial sector, where banks and other institutional firms are working with the cryptoasset space like never before. A growing number of traditional financial services firms and investors are launching crypto products and services in response to insatiable client demand.

Freer, fairer and more accessible for all

These twin trends are having an undeniable transformative impact on the world of cryptoassets. The proliferation of new products and services – and the entry of traditional financial services firms into the space – offer the foundation for true crypto-asset adoption. At Elliptic, it has always been our vision that this will produce a financial sector that is ultimately freer, fairer and more accessible for all.

However, the truth is that this development carries inevitable risks. for example:

- DeFi presents opportunities for criminal exploitation and offers a mechanism for money laundering without applying know-your-customer provisions (KYC blockchain).

- NFTs offer a new potential method of money laundering using cryptoassets, as well as opportunities for fraud and manipulation.

- Sanctioned actors and nation-states are showing that they are capable of exploiting new innovations in the cryptoasset space and can exploit gaps in the regulatory framework. This risk has particularly escalated globally following the Russian invasion of Ukraine in February 2022.

- As cryptoassets and traditional financial sectors converge, there will be new opportunities for criminals to take advantage of this complex landscape – transferring funds from the fiat economy to the cryptoasset ecosystem and back again.

It is therefore more important than ever that governance, risk and compliance professionals understand the evolving nature of illicit behavior and typologies of financial crime in the cryptoasset space.

Elliptical Typologies Report 2022

First published by Elliptic in 2018, “Report on typologies” is still the only comprehensive study of cryptoasset-specific typologies, red flags, warning signals and practical case studies.

The 2022 edition contains 41 typologies broken down into: Money Laundering, Terrorist Financing and Criminals and Threat Actors.

It serves as a detailed guide to the typologies of money laundering and terrorist financing and reveals the real impact of illegal activities on the crypto-asset industry, its users and its partners. Elliptic intends this study to make a significant contribution to the cryptoasset industry as it works to root out illegal actors.

This report is designed to equip governance, risk and compliance professionals with the knowledge and insights needed to proactively and practically:

- Identify the specific risks of money laundering and terrorist financing.

- Develop anti-money laundering and terrorist financing management systems (anti-money laundering/CTF transaction monitoring).

- Develop existing controls to manage risk to businesses, customers and society.

What does the market say?

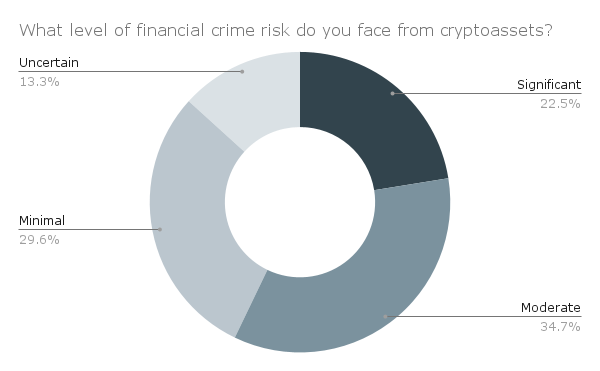

To better understand how compliance and risk management professionals are responding to the challenges and risks posed by cryptoassets, we surveyed around 100 risk and compliance professionals in the crypto and financial sectors.

More than half of respondents (56%) said they face a “significant” or “moderate” risk of financial crime from crypto-assets. Meanwhile, confidence in their ability to detect cryptocurrency-related financial crime to a high degree of accuracy is split 50/50 between the confident and the less confident.

Blockchain analysis and screening tools like Elliptic are becoming more common. Although, as the report states, the biggest challenge for respondents’ businesses in detecting financial crime in cryptoassets remains “identifying transactions that exhibit characteristics of structuring or other money laundering behavior.”

Throughout the report, we provide insight into a number of red flags of structuring activity involving cryptoassets. But we recommend reading Chapter 10 on “Wallet-Specific Behavior” specifically for insight into detecting this type of activity.

As for the new crypto-asset innovation that poses the greatest risks from financial crime, the most popular answer – chosen by almost 47% of respondents – was DeFi. In Chapter 3 of this report, we outline the typologies commonly associated with the DeFi space and provide recommendations on how to spot them.

To learn more about the risks associated with the DeFi space, as well as compliance strategies to address them, you should also read Elliptic’s November 2021 report: “DeFi: Risk, Regulation and the Rise of Decriminalization”.

The full survey findings will be published as a supplement to the Typologies Report in the coming weeks.

But you can download a copy in its entirety “Report on typologies 2022” today until by clicking here.

Compliance with NFT sanctions