UPDATE (May 16): Terra now claims that the movement of $3.5 billion in Bitcoin reserves – as described below – was carried out to sell most of it, in an unsuccessful attempt to prop up the UST stablecoin. Holders of LUNA tokens and UST stablecoins have collectively lost around $42 billion over the past week. However, $85 million in cryptoassets remains in Terra’s reserve to compensate them.

After the collapse of Terra’s UST stablecoin, questions were raised about the fate of $3.5 billion in Bitcoin (BTC) held in reserve to prevent just such an outcome. We use ellipticals blockchain analytics tools to track BTC reserves as they were moved after the UST crash.

TerraUSD (UST), an algorithmic “stable coin” created by Terraform Labs, has fallen this week. Intended to maintain its peg to the US dollar, the value of 1 UST fell from $1 to a low of just $0.04 – leading to billions of dollars in losses for UST holders.

Perhaps anticipating the failure of the mechanism intended to maintain that tether, Luna Foundation Guard (LFG) – a non-profit organization founded to support the growth of the Terra ecosystem – announced that it would buy up to $10 billion in Bitcoin and other cryptoassets, to act as a reserve to support the UST. stable currency. Between January and May of this year, 80,394 BTC – worth $3.5 billion at the time – he bought LFG.

When the value of the UST began to decline on May 9, LFG announced that it would begin to dispose of its bitcoin reserves and buy UST – to try to maintain the UST’s peg to the US dollar. Over the next day, the Bitcoin addresses holding the LFG reserves were emptied. As the value of the UST stablecoin continued to decline, questions were raised about the fate of the LFG Bitcoin Reserve and whether it was actually used to support the value of the stablecoin.

Here we use Elliptic’s block analysis software to trace the money trail and discover the fate of LFG Bitcoin.

On the morning of May 9, LFG announced that “Lend $750 million BTC to OTC trading firms to help hedge UST bonds“. Creator Terre Do Kwon later clarified that Bitcoin will be “used for trade“.

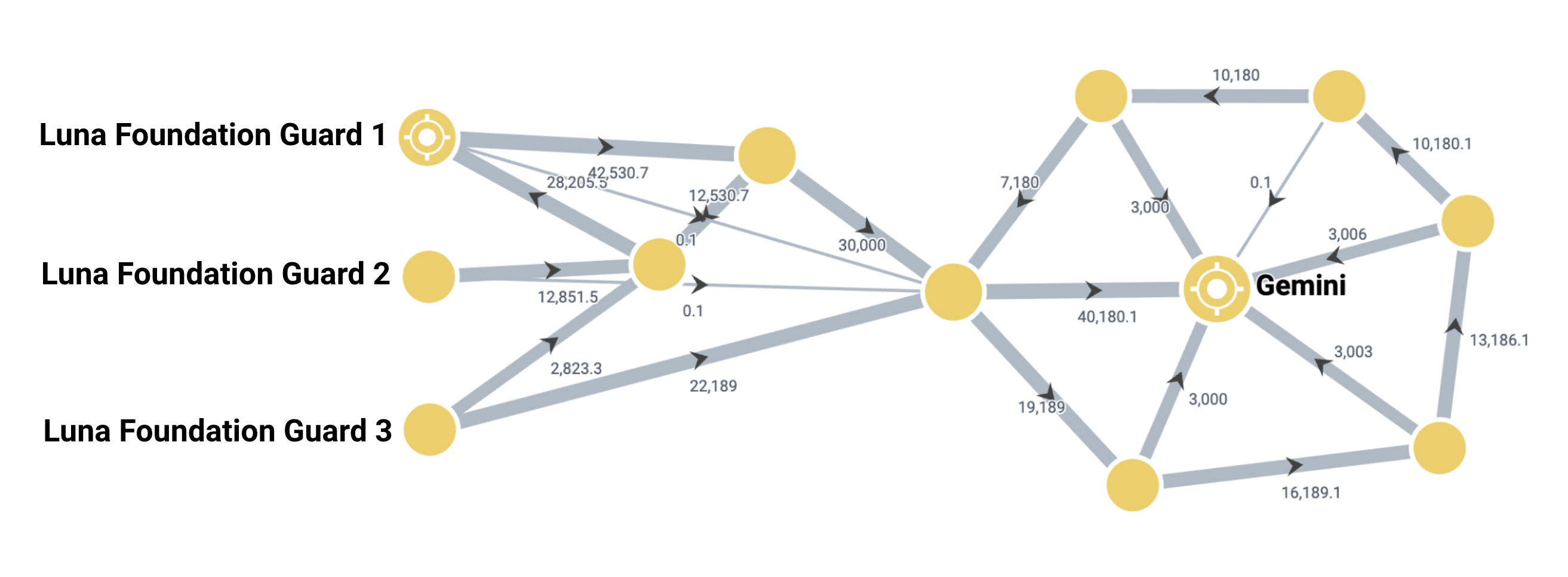

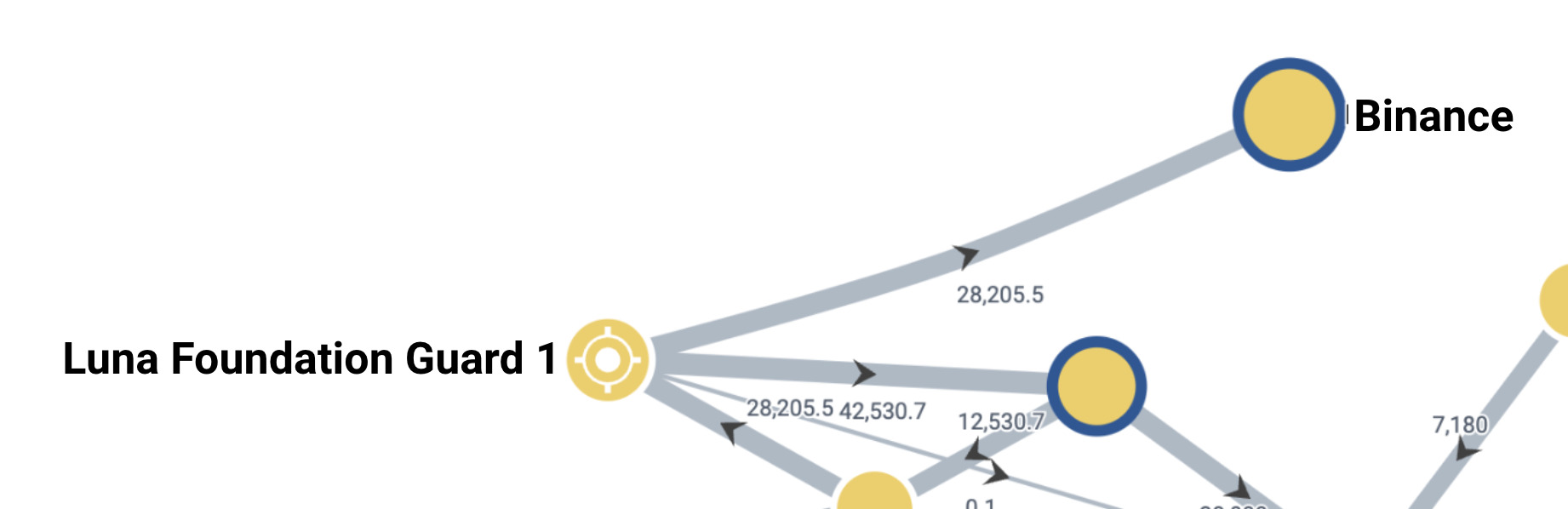

Around the same time, 22,189 BTC – worth roughly $750 million at this point – was sent from a Bitcoin address associated with LFG, to a new address. Later that evening, an additional 30,000 BTC – then worth about $930 million – was sent from other LFG wallets, to the same address.

Within hours, all of these 52,189 BTC were subsequently transferred to a single account at Gemini – an American cryptocurrency exchange – through several Bitcoin transactions. It is not possible to further trace the property or determine if it has been sold to support the UST price.

This left 28,205 BTC in Terra’s reserves. At 1:00 UTC on May 10, this was moved in its entirety, in one transaction, to an account on the crypto-asset exchange Binance. Again, it is not possible to determine whether these assets were sold or subsequently moved to other wallets.

Those looking to recoup losses incurred due to UST exposure may be interested in determining whether these Bitcoins remain on these exchanges.

How we can help

To learn more about risk and regulation in the DeFi space, download our elliptical report in which we examine the concept of DeFi, what it actually is isas well as the associated risks, how DeFi is regulated (or not) and potential compliance and controls for DeFi financial crime.

DeFi Crypto Crime Crypto Businesses