We’ve all heard about Bitcoin and how its price has risen dramatically over the years, but what about investing in Ethereum?

Often times, people wonder how to diversify their cryptocurrency portfolios and ask themselves, “Should I invest in Ethereum?“?

With recent price volatility and changes in blockchain technology, it’s easy to understand why many investors are wary of buying the second-largest cryptocurrency on the market.

In this post, we will explore Ethereum and its recent market performance, New Ethereum ETFsand the updates to its network. We will also discuss the future potential of Ethereum and some of the challenges that blockchain technology may face.

Table of Contents

Current state of Ethereum

Ethereum is the second largest cryptocurrency by market capitalization after Bitcoin.

Prices have seen significant volatility in recent months, leading many to question their investments in digital assets.

As of August 2024, Ethereum is trading at around $2,637, a significant drop from its level in March 2024, when it was trading at over $4,000.

But it is not all downhill for Ethereum, an asset that has shown volatility but is also capable of recovering.

In October 2024, the price hit a low of $1,500 and is now on track to double that number.

Ethereum Exchange Traded Fund

The biggest development in the Ethereum ecosystem is the newly approved ETFs trading on the US market.

This allows you to buy Ethereum without having to buy the cryptocurrency directly. By purchasing Ethereum ETFs, which track the price and performance of Ethereum, you can access a regulated investment in cryptocurrencies.

Although many crypto investors are happy and excited about the SEC’s approval of Ethereum ETFs, some crypto enthusiasts are questioning the decision and the potential impact it could have on decentralization and self-custody of cryptocurrencies.

Developments and upgrades in blockchain technology

In 2022, the transition to Ethereum 2.0 began. This included several updates to the network, most notably the transition of the system from Proof of Work (PoW) to Proof of Stake (PoS). This move was widely known as the “merge.”

Since then, developments have not stopped as continuous improvements have been made to the network’s energy consumption, hashrate, and allowing ETH to be staked.

The Future of Ethereum

Trying to predict the future of Ethereum is not an exact science, but according to many financial analysts and cryptocurrency experts, it has an optimistic future.

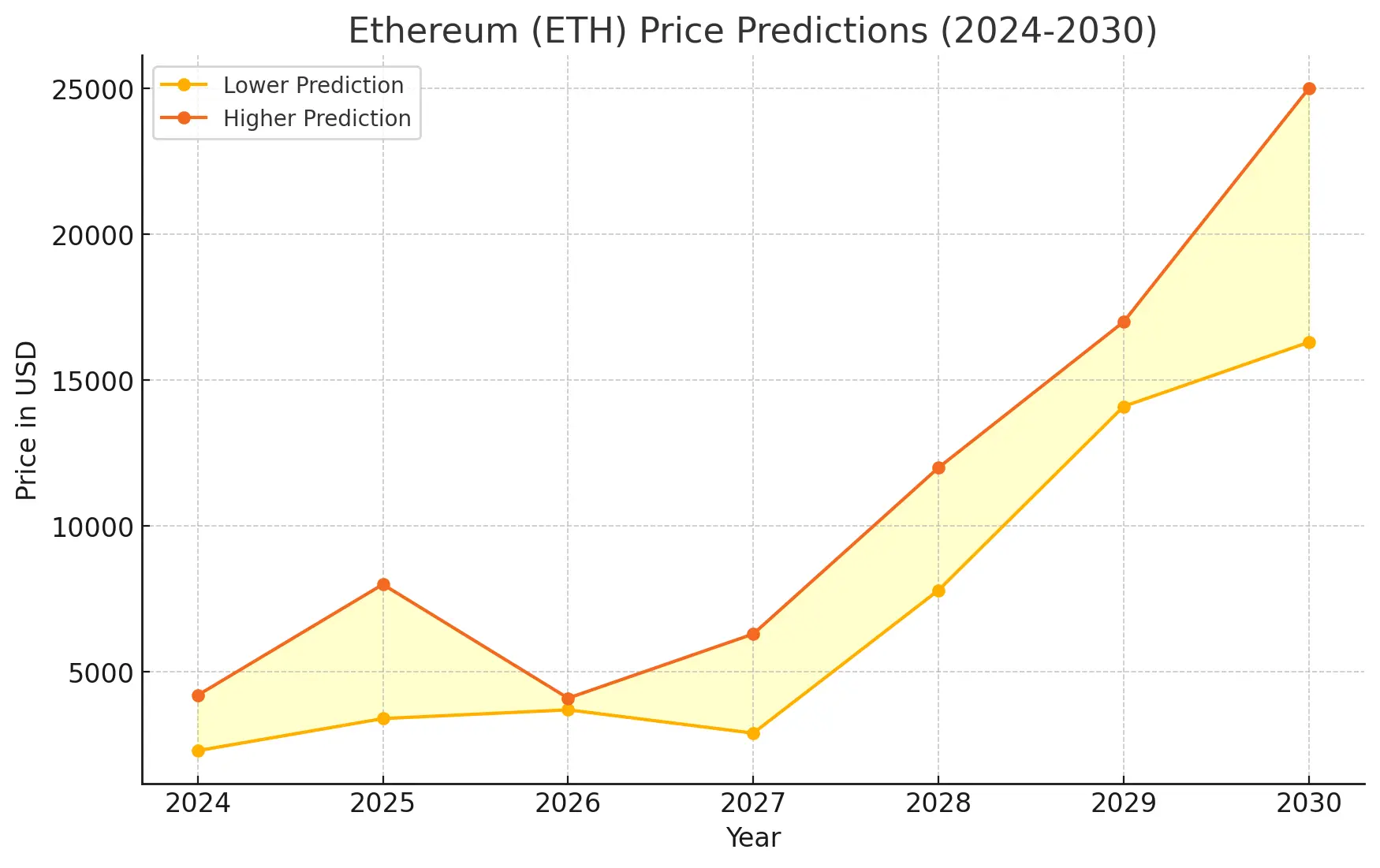

Ethereum has a strong position not only as a cryptocurrency but also in the world of smart contracts. Some experts have even predicted that the price of Ethereum will reach between $10,000 and more than $20,000 by 2030.

The potential growth of Ethereum is directly tied to the blockchain and how the world adapts to its new technologies. With the growing popularity of decentralized finance, NFTs, and other applications, the platform shows no signs of slowing down.

Adoption and use of blockchain technology

Aside from the ETH token, the Ethereum platform is primarily used for decentralized applications, known as dApps.

As of 2024, Ethereum has become the primary blockchain for decentralized applications, including decentralized exchanges (DEXs), lending platforms, gaming, and NFT marketplaces.

Challenges

There is some competition on the Ethereum blockchain, with other competitors such as Solana, The dottedand Cardano Entering space.

These blockchains have become popular because they are known to be faster and have lower fees, however, Ethereum’s new Proof of Stake model offers a more competitive advantage.

How to invest in Ethereum

When it comes to investing in cryptocurrencies, there is no one-size-fits-all approach. You should review Objectives, Future goalsand take risks Before investing.

Fortunately, there are some methods that have been around for a long time: Average cost in dollars, Keepand Active trading.

1️⃣Dollar Cost Average (DCA)

This strategy involves taking a fixed amount of money and buying Ethereum at regular intervals, regardless of the price at that moment. This method is very popular among cryptocurrency investors because it is a way to reduce risk in the volatile cryptocurrency market. Trying to time your entry and exit perfectly is time-consuming and stressful, so with averaging, you can buy little by little and constantly, and no matter what the price point is, you will eventually reach the average.

2️⃣HODLing

The HODL method is based on holding for a long period of time. This means holding Ethereum tokens for years, regardless of what happens in the market in the short term. The idea is that the value will always increase over time. This is a very popular investment strategy, not only in cryptocurrencies but in stocks as well.

You must be strong and not get emotionally affected when the markets turn and fall. You must be patient and endure the volatility of the cryptocurrency market.

3️⃣Active trading

It is an investment strategy that requires skill and good knowledge of Ethereum technical analysis.

Active trading involves buying and selling ETH frequently, taking advantage of momentary price movements.

This strategy can include different types of trading, including: Day trading or swing trading.

Active trading in Ethereum can be profitable, but it is also risky. It requires someone with experience and good knowledge of the market.

❌This is not for new crypto investors.

Protect your Ethereum

After investing in Ethereum, one of the most important aspects is how to protect your assets. As cryptocurrencies become more popular and accepted worldwide, the number of hacks and scams has also increased.

Storing your cryptocurrencies in one of the best Ethereum wallets is vital for their safety and security.

Use Cold cryptocurrency walletlike Material Ether, is the best strategy to protect your assets.

Ether is designed to store your Ethereum. Totally offlineThe wallet is made of stainless steel, making it virtually indestructible and resistant to shock, fire and flooding.

Should I invest in Ethereum now?

When deciding whether or not you should invest in Ethereum now, you need to consider the potential rewards versus the risks of the cryptocurrency market.

➡️timing This is one of the biggest challenges that investors face when deciding which assets to buy. Since cryptocurrencies are known to be a volatile market, prices can swing quickly and dramatically.

But it’s important to consider the historical outcome of Ethereum. Is the current price lower than it was in the past? Yes. But is it higher than its lowest low? Yes.

💰Investors who bought during the steep declines and held their investments during volatile market cycles are the ones who get rewarded.

While we can’t guarantee that you will always make a profit on your Ethereum investment, buying on dips has historically proven to be a successful strategy for long-term investors.

➡️Belief in the Ethereum Project Investing in Ethereum is another important aspect of your investment. Since the Ethereum blockchain is not just a cryptocurrency, it is important to understand the long-term vision of the project and follow it through to the end.

The Ethereum community is an active and dedicated group in the crypto space, with developers constantly working on upgrades and new features.

➡️Current price vs. historical highsThis may be the best time to invest in Ethereum, even if the current price is lower than the historical price. Remember, this is not a bad thing in itself. Look at it as an opportunity to buy low and sell high in the future.

Medrex conducted a research in which it predicts the following growth for Ethereum (ETH).

Why Ethereum is a Smart Long-Term Investment

Investing in the Ethereum blockchain is a great option for long-term investors who believe in the future of DeFi.

Because Ethereum has a strong community, constant upgrades, and plays a vital role in the world of NFTs and smart contracts, it is well positioned to grow over time.

If you decide to invest in Ethereum, always make sure to prioritize the safety of your investment. Use a secure broker Cold crypto wallet To protect your ETH from online threats and scams.