There is enormous potential when investing in Bitcoin, but it also comes with some risks, especially because of Bitcoin fluctuations.

One of the main decisions that you need to make when entering the encryption market is, “Should I invest simultaneously with a broken amount, or should I post it over time using the DCA strategy? “

Understand DCA against bitcoin cut The discussion is very important.

Choosing the right approach is important because the price of bitcoin can swing quickly and greatly.

If you do not have a strategy, it is easy to buy in The wrong time and Miss On possible great gains.

In this article, we will dismantle everything you need to know DCA for a broken amount bitcoin investment.

Bitcoin investment timing is difficult even for The best investorsFor this reason, the use of a well -planned strategy is essential.

in BitcoinWe help the encryption investors protect bitcoin through The safest cold storage solutions Providing tools like our Bitcoin Buy Signal Signal System to help you make more intelligent investment decisions.

With years of experience in bitcoin security strategies and investment strategies, Bitcoin It is your successful successful partner in the encryption market.

👉 Ready to choose the best Bitcoin investment strategy?

índice de contenidos

What is the best strategy for investment in bitcoin?

When it comes to developing your Bitcoin portfolio, it is difficult to know exactly the strategy that will work better.

The decision between DCA for a broken amount bitcoin investment It depends on many factors, such as tolerance of risks, investment goals, means, and how they interact with market fluctuations.

The cost of the dollar is on average (DCA) involves investing smaller and consistent amounts over time.

The idea in this strategy is to help reduce emotional tension from large market fluctuations.

Total investment amount It means putting all the money available in Bitcoin once.

Historically, this strategy provides higher returns in the increasing markets but can be very dangerous if prices decrease.

Using DCA to invest in Bitcoin

The average cost of the dollar (DCA) is a simple investment strategy as it publishes your bitcoin purchases over time by investing a fixed amount at regular intervals, regardless of the price at that time.

Instead of the timing of the market, the idea is the average purchase price by purchase during highlands and declines.

Imagine you invest $ 100 in Bitcoin every week for one year.

A few weeks, bitcoin may be at $ 80,000; Other weeks, it can decrease to $ 45,000.

In theory, your purchase price should be average, and protect you from making a significant investment before a significant decrease in prices.

This approach is popular with beginners because it removes the passion from the purchase process and puts the importance on the consistent purchase.

However, this is not the best Bitcoin investment strategy, as you may lose the main opportunities.

Advantages of using DCA to buy bitcoin

| feature | a description |

|---|---|

| Reduces the risk of timing |

|

| It builds consistent investment habits |

|

| Reduces emotional tension |

|

| The ability to “buy Dip” automatically |

|

📈 An example of the real world

If you are dca’d 100 dollars per month In Bitcoin from the end of April 2020 to April 2025, your total investment $ 6,100 It would grow up to nearly 14,486 dollars. This is a 137.49 % increase In your Bitcoin for 5 years.

DCA strategy risks and disadvantages

At a glance, the use of DCA strategy seems to be a safe bet to get encryption returns.

But there is some fall to rely only on this investment method:

🐻📉 Underperformance in the bear markets:

- It is important to note that DCA is not guaranteed. in Long bear marketsAs in 2018-2019, DCA investors had negative returns for several months before recovery. DCA does not prevent losses. It only reduces the effect of bad timing.

🚀💸epportunity costs through the bull markets:

- If Bitcoin enters a strong upward trend after starting DCA, your small and late purchases may mean that you miss you Greater gains When compared to broken investment.

Buyblind buy without signals:

- The use of standard DCA technologies is investing in Bitcoin without looking at market trends or signals. Using tools such as Bitcoin material purchasing a signal system It can be the game change. Our system alerts you when the market conditions are statistically more suitable for bitcoin, which helps you improve your approach by buying more intelligent in critical moments.

How does the investment amount work in Bitcoin?

The broken investment is the place where you invest the full amount in Bitcoin once.

It’s direct: If you have $ 5,000 to invest, you buy $ 5,000 of Bitcoin immediately.

Do not divide it into smaller scheduled purchases, such as the average cost of the dollar.

Example

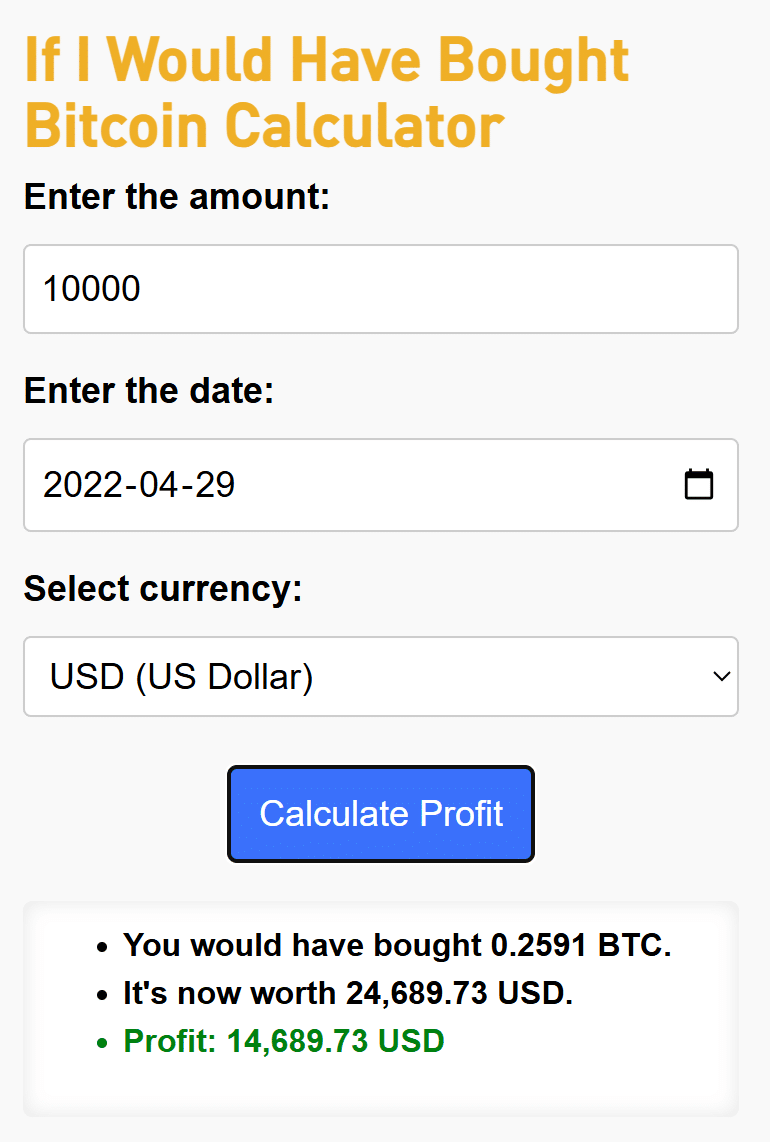

Imagine that you received a $ 10,000 bonus At work in April 2022 and invested everything in Bitcoin. As of today, this investment had returned $ 14,000 profit, Growth more than 140 % In just 3 years.

Benefits of investment in one time

| 📈 The amount of investment benefits |

|---|

Top historical returns:

|

Immediate exposure in the market:

|

simplicity:

|

The risks of investing in the total amount

The timing of the market and the emotional challenges are the two main Salvitis for a cut investment.

It may be difficult for many people to see their investments drop quickly and unexpectedly.

But if you understand the game and you realize that BTC can swing between 3 % and 5 % a day, the broken investment in the long -term reservation should not be a problem.

You have a greater opportunity to see higher returns when buying Bitcoin in a lump sum when using the Buy the Dip strategy than any other investment strategy.

DCA for a broken amount bitcoin investment

Now that we have searched in both strategies, let’s see how DCA for Bitcoin Investments He performed.

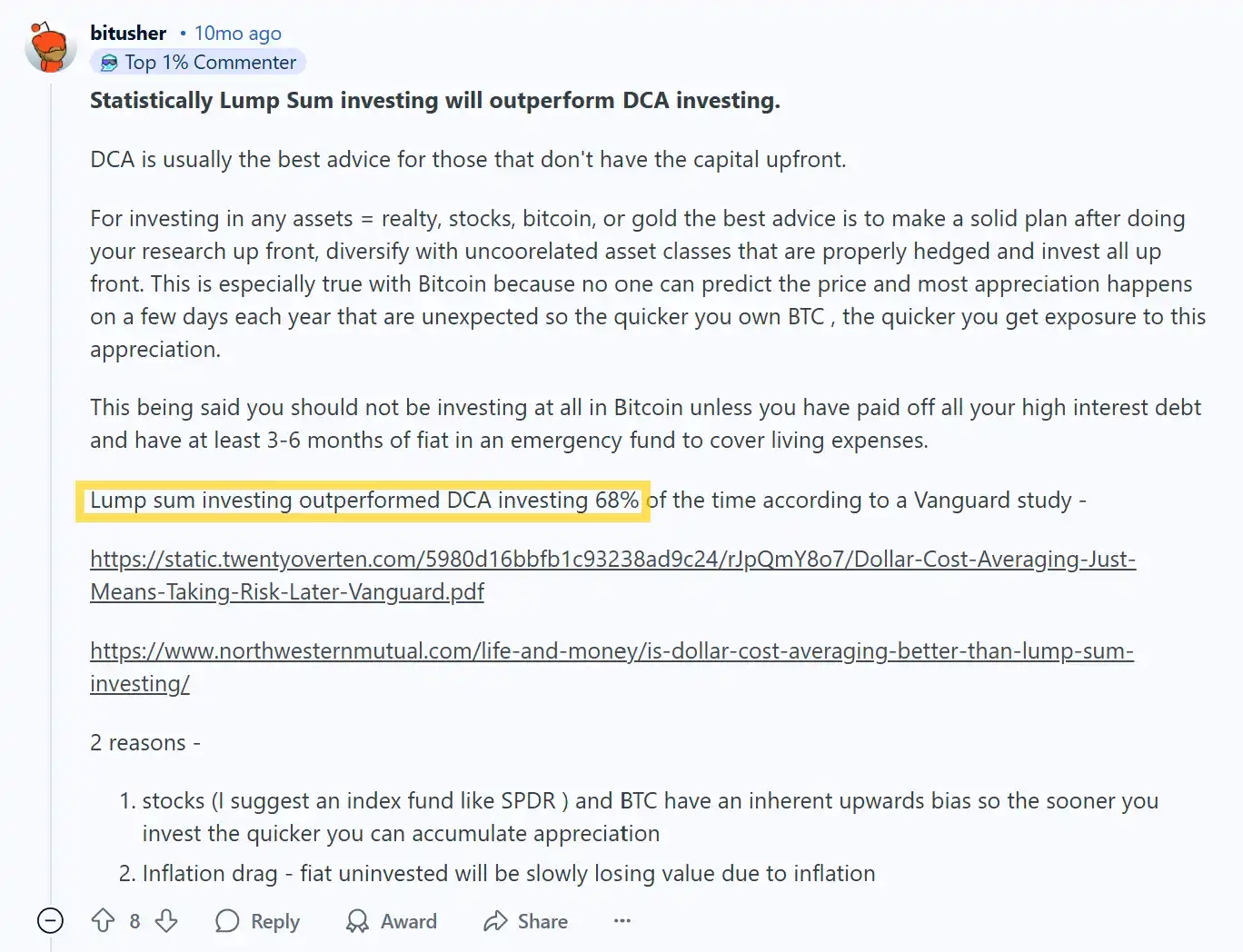

Historically, the broken amount out of DCA out of most of the time, especially in the bull market.

But how does this apply to bitcoin?

Here is an example to help explain:

| Investment method | details | The estimated return |

|---|---|---|

| 💰 Clated amount | I have invested $ 10,000 in Bitcoin in April 2022 When BTC was about $ 40,000. The value by April 29, 2025, exceeds $ 95,000. |

📈 ~ 850 % profit. |

| DCA | $ 100 a week over 156 weeks = 15600 dollars the total. Buy higher during the bull run. middle. The basis of affected cost. |

📈 ~ 60 % profit (depending on price work) |

💡 The main fast food: In the upscale direction markets, the broken investment will give you much higher returns.

Enhancing your investment strategy with purchase signals

The DCA application may mean blindly that you pay the excess amount during price mutations, especially in the bear markets.

To reduce these risks, use tools like Bitcoin material purchasing a signal system.

This system uses market indicators and trend data to alert you when statistical possibilities prefer purchase.

📘 Learn more about encryption investment strategies

Do you want to learn more about investing in encryption and building a long -term wealth? Check out other expert evidence:

- Beginner for encryption investment

- How to use fear and greed index

- Commercial educational arbitration for encryption

in BitcoinWe are here to help you invest more intelligent and protect encryption in the right way.

How to reduce risks when making an investment amount

Bitcoin broken investment can give you strong returns, but it also comes with greater exposure to short -term price fluctuations.

If you choose this investment strategy, you should follow these practices to reduce the risks that can be avoided.

💡 Never invest emergency savings

Your investment funds should be separate from the money you need for necessities.

It is best to deal with your bitcoin investments Long -term capitalNot money you may need to reach soon.

🎯 Set realistic price goals and time tables

Avoid obsession with short -term fluctuations.

You will feel crazy.

🔐 Use cold storage with bitcoin material

One of the biggest risks of encryption is not the volatility of prices; that it Sponsorship and protection.

After purchasing your encryption, never leave it on the stock exchange.

Instead, transfer it to a cold wallet like the bitcoin material.

Our physical Bitcoin portfolios provide a storage in a non -contact mode to keep your encryption in a safe from infiltrators, hunting, and platform failure.

Common questions

Common questions

Can you combine DCA approaches with a sum?

- Yes. Many investors divided their investments, put part of a cut amount and published the rest through DCA. Just make sure to review your goals to comply with your best strategy.

What happens if you invest in Bitcoin and the market decreases immediately after that?

- Short -term drops are common in bitcoin. If you believe in Bitcoin in the long run, you should keep the panic and avoid it.

Is DCA better than a lump sum during the bear market?

- DCA can help reduce the average cost during lower prolonged prices. However, the use of tools such as purchase signals can improve DCA by avoiding clear declines.

When is the broken amount invested in a more intelligent choice?

- The broken amount tends to perform better during the strong bull markets or when the general trend is upward. Historical data shows that the broken amount usually outperforms DCA about two thirds of the time.

Should I always move Bitcoin to cold storage after buying?

- definitely. Always go to a cold safe wallet like Bitcoin Material as soon as you buy.

[ad_2]