From 2015 to 2021, we saw a reversal in crypto regulation. At the time, regulators and supranational organizations, such as the FATF, began to set standards and expectations for addressing financial crime in crypto. As more jurisdictions issue guidance to apply their existing frameworks to the world of cryptoassets, one trend has emerged: the way a jurisdiction regulates cryptoasset products is likely to reflect its approach to a traditional financial product. Countries with laissez-faire attitudes towards market regulation have, in general, been quicker to embrace cryptoassets than those introducing stronger controls over traditional financial products.

.png?width=1200&name=Crypto%20regulation%20in%202015%20(2).png)

In 2015, cryptoasset regulation was still nascent, with few countries addressing the new asset class in any meaningful way. Guidelines which was often born out of fear and sought to tackle the problems of financial crime without adequate consideration of the consequences this might have on innovation and growth. Regulators wanted to learn more about the world of cryptoassets, but were often overwhelmed by the speed at which cryptoassets developed.

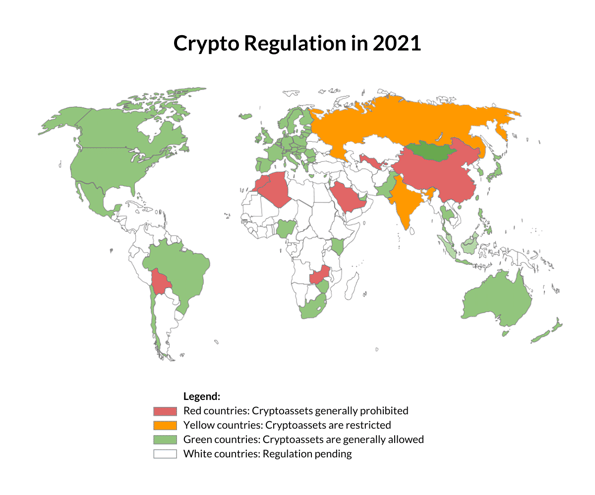

By 2021, the crypto regulatory landscape has completely changed. As cryptoassets matured, regulatory regimes around the world developed a better understanding of the implications of blockchain technology and began developing tailored guidelines. Globally, regulators have sought to regulate cryptoassets as means of payment, securities and commodities, with different regulatory ordinances applying to cryptoassets depending on the use case.

By 2021, the crypto regulatory landscape has completely changed. As cryptoassets matured, regulatory regimes around the world developed a better understanding of the implications of blockchain technology and began developing tailored guidelines. Globally, regulators have sought to regulate cryptoassets as means of payment, securities and commodities, with different regulatory ordinances applying to cryptoassets depending on the use case.

North America

In North America, where cryptoassets are generally permitted by law, questions have arisen about what type of regulatory scheme should be applied. Both the US and Canada have expressed clear standards for when a crypto-asset should be treated as a security, and increased regulatory scrutiny is expected here. Applying AML program requirements to cryptoasset exchanges has also become the norm, with the US, Mexico and Canada requiring licensing and implementation of AML programs similar to those of traditional entities. Although North America is generally crypto-friendly, centralized third-party administrators may face significant upfront and ongoing licensing and compliance costs.

Latin America

Latin America has seen significant cryptocurrency-related regulatory turmoil over the past six years. While some (e.g. Peru and Ecuador) have severely restricted (or even banned) crypto-assets, others such as Brazil and El Salvador have taken mostly supportive positions, with El Salvador proposing to adopt Bitcoin as legal tender. In Venezuela, cryptoasset markets are tightly controlled, but the government has sponsored an oil-backed cryptoasset (Petro), which poses a major law enforcement challenge for the US and other jurisdictions seeking to impose sanctions on the country.

Europe, the Middle East and Africa

Regulators have been clear here: the anti-money laundering provisions of EU-wide regulations, such as 5AMLD, should apply to crypto-assets in the same way as to traditional financial products. Although the UK has left the EU, it has implemented 5AMLD controls and is considered a partner in the pan-European effort to reduce financial crime. The Middle East has competing approaches: some states, like Saudi Arabia, effectively ban cryptocurrencies, others (eg the UAE) see it as an opportunity for growth. Africa maintains a hub of crypto innovation in the Seychelles, which provides an open sandbox for cryptocurrency development, but lacks many of the expected regulatory controls.

Asia Pacific

China has severely restricted the ownership and use of cryptoassets, and the government is requiring financial institutions to cut all ties to cryptoasset exchanges and custodians. They have not abandoned blockchain technology, however, and the launch of a Central Bank digital currency is expected soon. Elsewhere, Singapore has become a global hotbed for crypto innovation, with a strong regulatory regime and market-friendly regulation providing a solid foundation for crypto-asset operators to launch. This is especially true for ICOs, which are now predominantly launched from Singapore due to its well-established and reliable crypto legal environment.

Conclusion

Although the crypto regulatory landscape continues to evolve, we are now a world away from where we sat in 2015. International regulatory coordination organizations such as the FATF have acted and global regulatory expectations are clear. Only through the implementation of licensing regimes and KYC and AML controls can cryptoassets be part of a safe and robust financial ecosystem. As technology continues to evolve and decentralized finance becomes more integrated, it is expected that regulatory regimes around the world will continue to adopt new processes to combat the illicit movement of funds and ensure that consumers are protected from fraud and exploitation. These controls can be stressful and challenging for cryptocurrency participants, but they are good for the long-term health and sustainability of the sector and are critical to promoting mainstream asset class adoption.

Crypto relationship covered.

To learn more about cryptocurrency regulation around the world, see our Introductory Guide to Cryptocurrencies and Financial Institutions.

You can also subscribe to weekly updates on crypto regulatory affairs from Elliptic.

Regulation Global Articles