Crypto exchange AscendEX was hacked, leading to the loss of nearly $83 million in crypto assets. This comes just days after the theft $225 million from BitMart exchange and steal $140 million from crypto gaming platform Vulcan Forged, bringing the total value of cryptoassets stolen in just 14 days to $598 million.

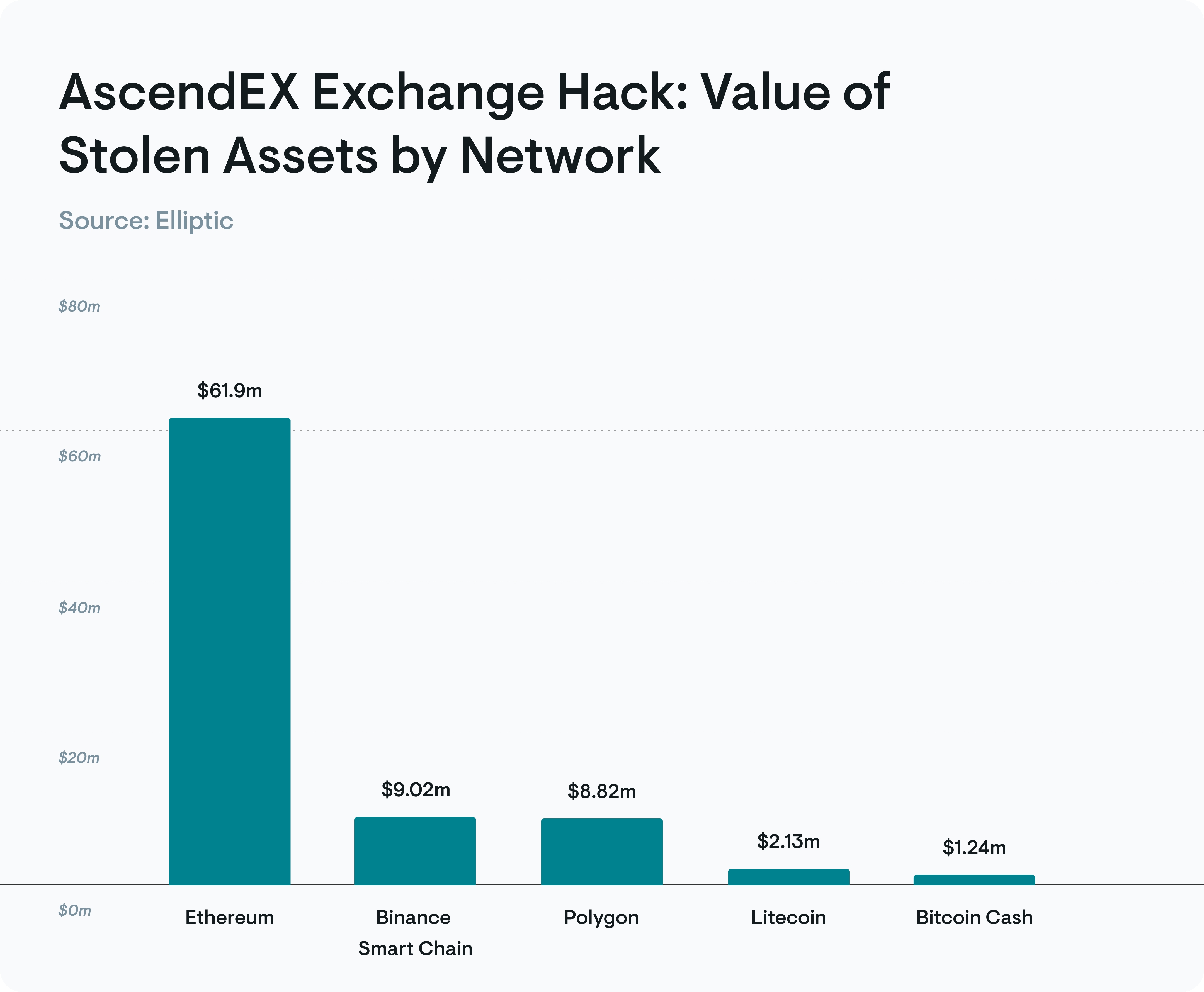

Elliptic’s analysis shows that on December 11 and 12, more than $82.89 million in crypto assets were stolen from AscendEX, an exchange based in Singapore. This includes more than $61 million in Ethereum-based assets and more than $9 million in assets on the Binance Smart Chain.

How the hack unfolded

Over the course of about one day, on December 11th and 12th, wallets belonging to AscendEX were emptied of more than 100 different crypto assets. This includes over $7 million in Polygon’s parent currency Matic (MATIC) and over $5 million in Ethereum’s parent currency Ether (ETH).

AscendEX confirmed the theft on Twitter on December 12, stating that one of the exchange’s hot wallets had been compromised.

Laundering stolen cryptocurrency

The two stolen stablecoins, Tether (USDT) and USD Coin (USDC), were exchanged for a third stablecoin – DAI. Both USDT and USDC can be frozen by the token issuer and therefore swapping to DAI ensures that a hacker avoids losing these funds.

In addition, the thief exchanged some tokens for ETH using Uniswap, a decentralized exchange (DEX). This technique is described in more detail in our new report — DeFi: Risk, Regulation and the Rise of Decriminalization.

The thief then sent most of the remaining tokens to a small number of addresses on the Ethereum, Polygon and Binance Smart Chain blocks, where they have since been split and sent to various other addresses in what appears to be an attempt to obscure the flow of funds.

So far, the thief has not tried to launder the stolen Litecoin and Bitcoin Cash.

More than 500 million dollars lost in 14 days

This loss of $82.89 million from AscendEX is one of five recent thefts that resulted in the loss of $598 million in crypto assets between November 30 and December 13, 2021.

On Monday, December 13, Vulcan Forged, a crypto gaming platform that also has a DEX and NFT market, reported a loss of 4.5 million PYR (Vulcan Forged tokens), estimated at 140 million dollars.

Furthermore, as pointed out by previous Elliptic blog postmore than $376 million in crypto assets were lost from BitMart exchange, DeFi service MonoX Finance and Badger DAO, a decentralized asset management service, earlier this month.

This comes on top of another $1.5 billion already stolen from DeFi services over the past year, as detailed in our DeFi report.

Learn more about how Elliptic’s blockchain analytics solutions help crypto businesses and financial institutions manage their cryptoasset risk.

Stablecoins DeFi compliance