In recent months, regulators and law enforcement agencies in a number of jurisdictions have expressed increasing concern about the prevalence of cryptocurrency fraud and scams involving Bitcoin ATMs.

Crypto kiosks allow users to buy Bitcoin with cash and vice versa. With more than 34,000 kiosks located worldwide, Bitcoin ATMs can help boost financial inclusion by offering those in underserved and heavily cash-reliant areas the opportunity to access digital financial services.

Unfortunately, however, some fraudsters have also identified crypto kiosks as a useful tool in perpetrating fraud.

In this article, we’ll look at Bitcoin ATM scams, common red flags, and describe how blockchain analytics can help address the risks.

Investment scams

According to an October 2022 warning from the US Federal Bureau of Investigation (FBI), Bitcoin ATMs are increasingly appearing in crypto-investment scams – or so-called “pig slaughter” scams that result in billions of dollars in losses to victims.

In these scams, criminals target victims via social media, establishing an online friendship or posing as a romantic interest, and encourage their victims to invest in crypto-assets with the promise of significant wealth.

After developing a trusting relationship with the victim, the fraudsters will persuade the victim to withdraw cash from their bank account and also provide them with a QR code linked to a crypto wallet that the perpetrators control.

The victim is then directed to deposit their money into a Bitcoin ATM. After the funds are converted into cryptocurrencies, the victim transfers them to a wallet designated by the fraudsters.

After receiving tens or even hundreds of thousands of dollars worth of funds from a victim in this way, the fraudsters will cut off contact with them – disappear with the funds, and then take steps to launder them, for example by using a Bitcoin mixer to disguise their final destination. Victims are often left completely financially devastated, in some cases parting with their entire life savings.

In committing investment fraud, fraudsters often rely on Bitcoin ATMs whose operators deliberately avoid compliance with anti-money laundering and counter-terrorist financing (AML/CFT) measures. Sometimes they are even aware that the kiosks they manage are being misused for illegal purposes.

In a recent case in March 2023, US law enforcement agencies arrested the founders of the Bitcoin of America ATM network, which operated over 2,000 kiosks across the US. Prosecutors allege that Bitcoin of America’s founders knew their kiosks were being used for investment fraud and continued to collect significant fees from users even when they suspected the transactions involved fraud.

Government impersonation scams

Bitcoin ATMs have also appeared in a number of government impersonation scams, in which fraudsters pose as representatives of pension agencies, tax authorities, utility companies or other similar organizations.

Acting under these guises, scammers will contact victims, claiming that the victim needs to settle debts – such as back taxes they owe or outstanding payments to settle an energy bill. Scammers will threaten the victim with jail time or other penalties if they don’t pay.

As with investment scams, scammers will instruct victims to withdraw cash from their bank accounts, convert the funds into cryptocurrencies, and then transfer their funds to a wallet belonging to the scammers.

Law enforcement in Australia has uncovered a scheme in which fraudsters posing as tax collectors tricked victims into making purported tax payments through Bitcoin ATMs.

Financial exploitation of the elderly

By committing these scams, fraudsters can also target one of the most vulnerable segments of society: the elderly.

Elder financial exploitation (EFE) involving crypto is a growing problem. The FBI pointed out that crypto investment scams involving the elderly totaled $123 million in 2021 – a number that is growing.

Elderly people are frequent targets of fraud because they often have significant financial resources, can be trusting and friendly, and are unlikely to report being a victim of fraud for fear that it could cause their family members or guardians to limit their financial independence. Some older people may also suffer from cognitive decline, which increases their vulnerability.

The rise of online banking and other digital financial services has also created new opportunities for abuse of the elderly, who may lack an understanding of digital financial services and may be coerced by fraudsters who attempt to exploit their lack of knowledge and understanding.

In some cases, scammers may direct older victims to deposit funds at Bitcoin ATMs, as older people may be more comfortable using cash than younger people, and may not be as comfortable opening online accounts with exchange services. Older people with significant retirement savings can be particularly vulnerable, as fraudsters can force them to make payments until their savings are depleted.

Last summer, an elderly couple in Michigan lost $350,000 to Bitcoin ATM scammers posing as Apple customer service personnel, and in April of this year, police in Alabama uncovered a similar scheme to coerce seniors into depositing cash at Bitcoin ATMs which are found at gas stations.

Key red flags

There are a number of behavioral and transactional indicators that can track these types of fraud and can help detect and disrupt Bitcoin ATM fraud. Key indicators may include:

-

the individual was instructed to make multiple cash deposits at various Bitcoin ATMs in dispersed locations, with deposits structured below the maximum deposit threshold;

-

an elderly person with no prior crypto-asset trading experience suddenly starts making large round-value deposits into Bitcoin ATMs;

-

when questioned, the cashing user clearly does not understand the crypto-asset and may appear confused when asked about their activity;

-

individuals may also sound panicked and fearful if contacted and questioned about their activity – especially if threatened by fraudsters;

-

large cash deposits are suddenly made to Bitcoin ATMs whose operators are not registered for AML/CFT purposes, or which operate with lax AML/CFT controls;

-

after receiving transfers from defrauded individuals, fraudsters transfer cryptocurrencies through mixing services or attempt to cash them out with high-risk virtual asset service providers (VASPs).

Identifying fraudsters using blockchain analytics

Fortunately, there are solutions to help identify fraudsters and their illegal crypto transactions.

Using a blockchain analytics solution like Elliptic, law enforcement investigators can identify wallets and transactions associated with Bitcoin ATM fraud and can trace the flow of funds from suspected hacks to cryptoasset exchanges and other VASPs to request account information that can help identify fraudsters. .

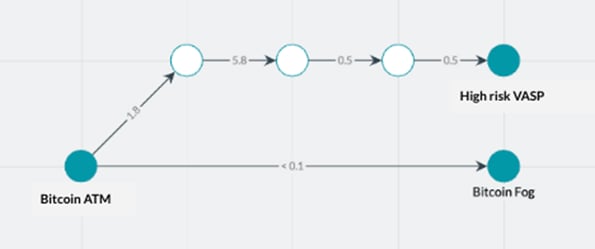

Image from Elliptic’s Software for researchers shows the flow of funds from a Bitcoin ATM to a high-risk crypto exchange service and the now-defunct Bitcoin mixing service known as Bitcoin Fog. Bitcoin ATM fraudsters may attempt to launder their ill-gotten funds through these high-risk services.

Similarly, VASPs, including responsible Bitcoin ATM operators who comply with AML/CFT measures, can use blockchain analytics to identify high-risk and suspicious transactions that allow them to report activities of concern to law enforcement.

Contact us to learn more about how Elliptic’s blockchain analytics solutions can enable the detection of fraud and scams in the crypto space.

Crypto Crime Global Law Enforcement