On the first anniversary of the Russian invasion of Ukraine, Elliptic published a report about how both parties have leveraged crypto to raise and distribute funds. One of the welcome findings from that analysis was that for every dollar of cryptocurrency raised by Russian military fundraisers, Ukraine raised about $44 – with cryptocurrency contributing a fifth of total fundraising for Ukraine.

Since the beginning of the invasion, jurisdictions around the world have imposed authoritative sanctions regimes to restrict financial flows to Russia and its proxies fighting in Ukraine. Although compared to the relatively efficient crowdfunding operation run by the Ukrainian government, the use of cryptoassets by Russian entities is therefore still an ongoing compliance issue for crypto services.

In that light – as the world marks the second anniversary of the invasion, we explore how Russian operatives have been unsuccessful in using cryptocurrencies to finance their war.

Crypto transfers to major Russian military fundraisers have been reduced

Our latest round of analysis of major military fundraisers suggests a welcome development: Having failed to replicate the success of their Ukrainian adversaries, many major Russian military fundraisers have either abandoned or significantly scaled back their crypto operations.

Voluntary Russian military fundraisers usually run on Telegram or a Russian social media platform Vkontakte, where they publish donation campaigns to support the various units fighting against Ukraine. The supplies they collect often include drones, weapon sights, ammunition, medicine, and clothing. Donations are generally received via electronic currency transfers, and crypto addresses are occasionally published as an alternative. Very rarely are crypto addresses the only option for donating.

Delivery of supplies advertised by groups that accept donations in part crypto.

The main fundraisers we identified in our 2022 report include the Coordination Center for Aid to Novorossiya, the Z-Coalition “OPSB” (which keeps the meaning of its acronym secret) and the Interregional Public Organization (IOC) “Veche”. No new large groups have emerged since that report. Certain military or mercenary units also often start their own fundraisers, the most notorious example being that of the now sanctioned mercenaries of the Wagner Group “DSHRG Rusich”.

The crypto operations of some of these groups appear to be almost obsolete. Since being sanctioned in September 2022, Rusich has sought legal means to prevent the extradition of one of his fighters from Finland to Ukraine. The linked crypto addresses barely received $200 in donations. It is not known if the campaign made significantly more in fiat donations.

Other fundraisers have made similar or no progress. Since our latest update in June 2023, Z-Coalition OPSB – which has all but stopped advertising its crypto addresses in recent fundraising ads – received $500 worth of crypto donations.

Donations to a small number of fundraisers have been more modest, however, since last June IOC “Veche” and Novorossiya Aid Coordinating Center have received $40,000 and $9,000 respectively in crypto. However, this only accounts for 2% of the total funds received in “Veche” wallets – the vast majority received in the immediate months following the invasion.

In comparison, the official (now closed) Ukrainian government fundraising has raised an additional $1 million since February 2023, while a further $3 million has been raised over the same time period by the Armed Forces of Ukraine charity Come Back Alive. In total, these campaigns have now raised more than $83 million and $29 million in cryptocurrencies – ten times more than all Russian fundraisers combined. The “Freedom of Russia” Legion, which is made up of Russian defectors as part of the Ukrainian armed forces, has more than tripled its crypto donations to over $170,000 – up from $52,000 last year.

Why are donations decreasing?

The decline in crypto donations to Russian fundraisers is not surprising, for a number of reasons. First, reports of donations and acquisitions made public by fundraising groups have long suggested that crypto accounts for a very small portion of contributions.

In 2022, a successful $221,000 fundraiser to build a drone, for example, raised roughly $8,400 in crypto — just 4% of total donations. It’s likely that for many groups, the low income in cryptocurrencies has made it more cumbersome than worthwhile to process blockchain transfers – especially when navigating Russian regulatory restrictions on cryptocurrencies when making donation payments.

The “People’s Drone” project – developed with donations, of which only 4% was created in crypto.

Donors probably have the same consideration. When donating is as easy and low-risk as sending funds to a publicly disclosed Sberbank or Tinkoff bank account number, there are several reasons why donors would choose to use cryptocurrencies.

Contributing to pro-war fundraising via bank transfer is also unlikely to carry any legal risk in the eyes of Russian banks or authorities, making the comparative pseudonymity offered by crypto an arguable advantage for donors.

What are the implications for virtual asset services?

Even the latest comparisons between Ukrainian and Russian fundraisers show that cryptoassets can largely be a force for good. The recent decline in the use of cryptocurrencies on the Russian side is further welcome and highlights that the risk of money laundering and sanctions for virtual asset services is bearable.

However, given that comprehensive sanctions regimes for such entities are still in place, those risks remain – and therefore mitigation procedures for virtual asset service providers remain necessary. Our previous analysisfor example, they found that 80% of the proceeds sent through Russian fundraisers end up in crypto exchanges.

This is especially the case given that – despite the overall trend away from cryptocurrencies – there are always rare exceptions that have a low probability, but a high chance of turning the tide. For example, the paramilitary group Imperial Legion of the Russian Imperial Movement – a sanctioned far-right ultra-nationalist terrorist organization – recently listed a Bitcoin and Monero donation address.

Imperial Legion posts crypto donation addresses next to Sberbank account number (left) and their fighters allegedly in Kharkiv (right)

Fortunately, as of February 2023, the Bitcoin address remains empty – again highlighting the general unattractiveness of cryptocurrencies to donors. An effective sanctions compliance regime is nevertheless necessary, especially if that situation ever changes.

How Elliptic can help

Elliptic can assist virtual asset services in ensuring that the risk of Russian military fundraising and related procurement initiatives can be managed.

Our work in this area helps services comply with and protect against exposure to these entities on several fronts:

1. Regular checks and assessments of fundraisers and other high-risk entities that accept crypto

We routinely monitor Russian entities for any new donation campaigns that accept cryptocurrencies – no matter how big or small. We flag sanctioned entities and their addresses in our tools, including preemptively before any crypto transaction takes place.

For example, if the Russian Imperial Legion ever receives its first Bitcoin donation, Elliptic clients will already be able to see and verify this sanctions/terrorist financing risk in our tools.

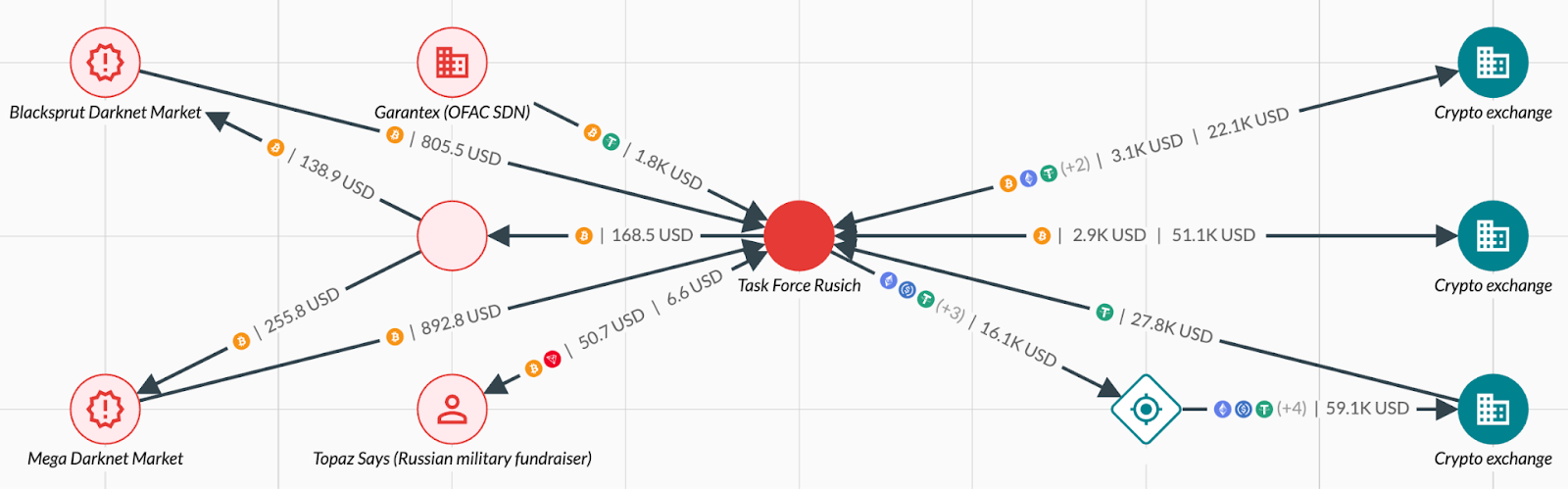

Elliptic Investigator tracks the illicit source and destination crypto exchanges of funds sent to Task Force Rusich – an OFAC-sanctioned paramilitary group affiliated with PMC Wagner.

Elliptic Investigator tracks the illicit source and destination crypto exchanges of funds sent to Task Force Rusich – an OFAC-sanctioned paramilitary group affiliated with PMC Wagner.

2. Monitoring the risk of sectoral sanctions

In addition to entities listed in various sanctions regimes, Elliptic routinely monitors the activities of groups within the region under sectoral sanctions – including Crimea, Donbass, Kherson and Zaporozhye.

These entities – which can range from fundraising to non-compliant crypto broker services operating in these regions – can be screened for sanction risk on our block analysis platform.

3. Analysis and assessment of relevant trends and typologies:

We analyze trends in the use of cryptocurrencies during the Russian-Ukrainian war and ensure that virtual asset services are abreast of significant changes that may affect risk-based consideration.

In general, Elliptic hosts comprehensive resources compliance with sanctions and typologies, as well as more specific trends such as cross crime.

Go to us resources page to browse our publications or Contact us for demo. Our team will be able to demonstrate how your organization can benefit from ours investigative, entity due diligence and wallet overview tools that ensure you are protected from the risks of war and sanctioned crypto activities.

Sanctions Highlighted globally