When you start investing in your 30s, you are taking steps to prepare for your future. By this age, most people are more financially stable than they were in their 20s, and have a clearer view of their long-term goals.

Investing, regardless of age, is crucial to ensuring your financial security in the future. It helps plan for your retirement and hedge against inflation. Starting in your 30s, if you haven’t already, is a good time to start.

There are a lot of misconceptions and concerns, and many people ask themselves, “Is it too late to start investing at 30?“- But the short answer is no.

In this post, we will guide you step by step on how and why you should start investing at age 30.

Table of contents

Why is 30 the right age to start investing?

When you start investing at the age of 30, you can enjoy many benefits.

At age 30, you have a clearer idea of your future goals and what you want to do in the next 10 years until retirement.

During your 30s, you will also have a more stable job, higher income, and a better understanding of finances. You will usually have started buying property or at least started planning your next steps on how to do so, so you have a more disciplined approach to budgeting.

But the key point to starting investing at 30 is that you can Benefit from compound interest.

This is a very useful tool that you can use to your financial advantage, and the earlier you start investing, the better off you will be. Compound interest is when the gains from an investment start to pay off.

This causes snowball effect Over time, this leads to more and more growth.

To help illustrate, let’s look at this example provided by the U.S. government’s Consumer Financial Protection Bureau:

This amount may seem small at first glance, but you have to take into account that the amount of compound interest you earn will increase every year.

Consider it “free money” that you wouldn’t be able to earn otherwise!

So, is 30 too late to start investing? No!

Imagine the growth you could achieve by the time you’re ready to retire.

To help you calculate your potential, you can use this free compound interest tool.

Steps to Start Investing at 30

Are you ready to start investing in your 30s, but not sure how? Here’s our step-by-step guide to help you get started:

1. Evaluate your financial situation.

Before you put your hard-earned money anywhere, the first step you should take is to take a look at your current financial situation. This includes reviewing your debts, credits, and any savings you may have.

- List your monthly income, expenses, and debts.

- Make it a priority to pay off your high-interest debts first, such as credit card bills or student loans.

- Keep an emergency fund. It is recommended that you have enough money to last 3 to 6 months.

These steps may seem daunting at first, and perhaps even unachievable. But the trick is to get started. Even if it’s a gradual process, knowing every penny and where it goes will help you in the long run.

2. Set clear financial goals.

Your next step is to decide what you want from your investments. We suggest that you decide: Short-term And Long term goalsThese can range from creating an emergency fund to buying a home and planning for retirement.

3. Educate yourself about investment options.

It is important to understand what investments and the different asset classes available. Some popular options include stocks, bonds, ETFs, index funds, cryptocurrencies, and commodities.

Do your research to understand the risks of each investment and evaluate the following: take risks He is.

In general, younger investors can afford to invest in more volatile assets like stocks and cryptocurrencies, as the long-term rewards historically pay off. In your 30s, you have time to build and wait out the ups and downs of the markets.

4. How to start investing at 30?

Once you’ve reviewed your options and know how much you can afford, start setting up investment accounts. If you’re afraid to invest your money in more volatile markets, start slowly.

We recommend starting with index funds or ETFs. But Remember to diversify your investment portfolio..

You can add small amounts of Bitcoin, which has shown high returns over the past decade. Always remember to store your Bitcoin in a cold cryptocurrency wallet for safe long-term offline storage. Later, invest in other assets such as treasury bonds or gold.

Once you feel more secure and confident in your investment strategy, you can start buying other types of cryptocurrencies, such as Ethereum or individual stocks. Always make sure to do your research and seek the help of a broker if you feel the need to.

Common Mistakes to Avoid When Starting Investing in Your 30s

Although starting to invest at age 30 is ideal, there are some important mistakes to avoid.

Jumping on the investment bandwagon because you heard about it on social media is No, no, big one..

You want to have a clear strategy for your investment portfolio, which means knowing exactly what the asset is, how it works, and feeling comfortable with the potential outcomes.

Making a hasty decision can lead to potentially huge losses. So, stick to your short-term and long-term goals.

If we had to pinpoint the riskiest move anyone can make when investing, it would be not diversifying your investment portfolio.

Investing all your money in one type of asset is extremely risky. To protect your money during a recession or sharp market downturn, you need to have other types of investments to help temporarily offset any losses you experience.

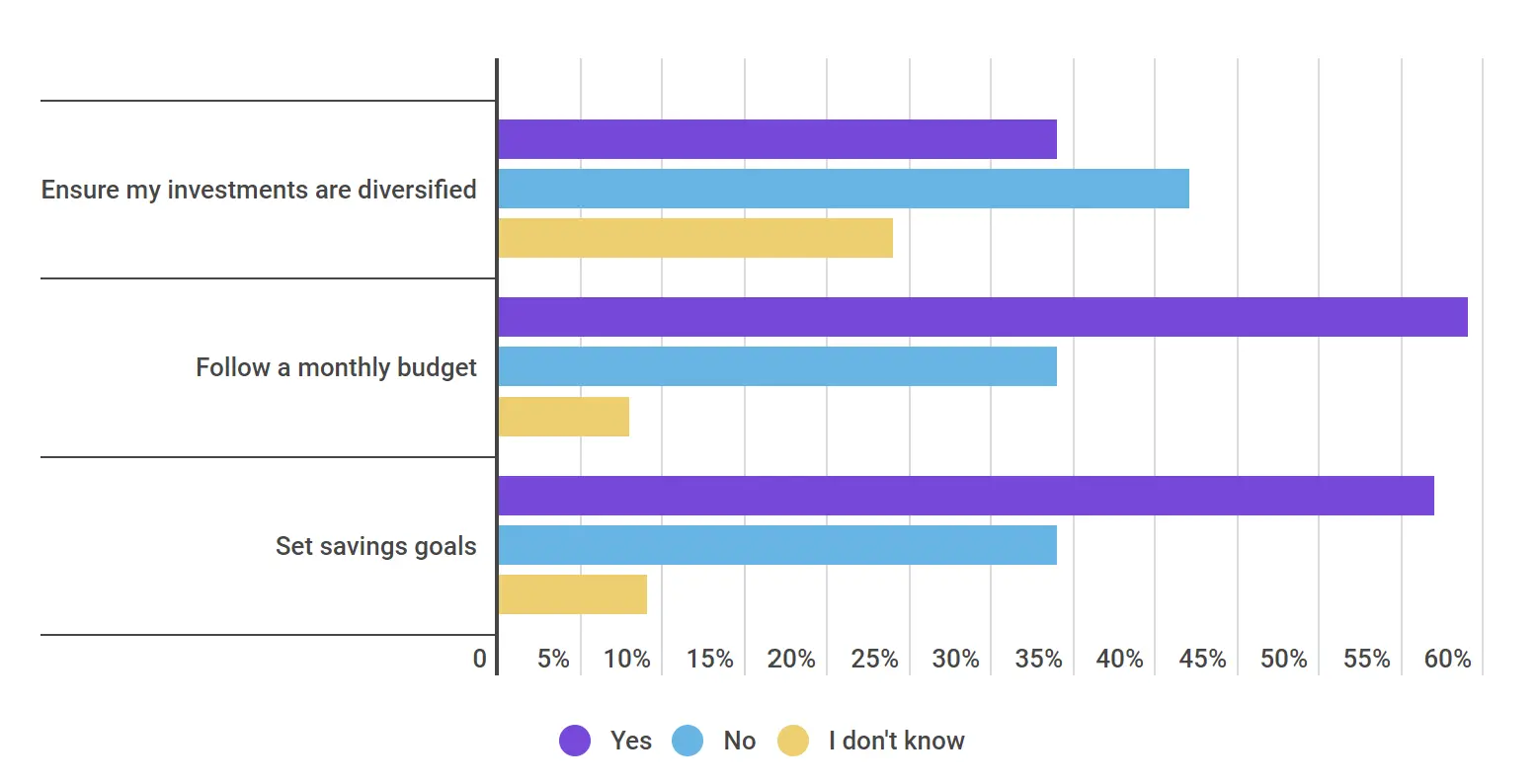

For example, a worrying number of Americans do not diversify their investment portfolios.

A study by CNBC News found that 42% of investors do not diversify their assets while nearly 40% of Americans do not have a budget and do not stick to it. These are some alarming statistics that reflect the lack of education and knowledge among American investors.

To reduce risk and ensure a consistent return on your investments, spread your investments across different asset classes such as ETFs, stocks, bonds, real estate, cryptocurrencies, and commodities.

Investment Success Stories

Investing for the first time can be a bit intimidating, but hearing real-life success stories can be the catalyst to help you get the boost you need.

We’re by no means saying that investing will always guarantee you’ll be a millionaire by the time you’re 60, but these cases help demonstrate the power of starting to invest at 30 and how you can benefit too.

One success story that stands out in particular is that of Rachel Siegel. At the age of 29, she was working as a substitute teacher and living off her monthly salary when she went to an after-party at a crypto conference in New York.

From that moment on, she decided to start investing and bought $25 worth of Bitcoin from the leftovers of her weekly salary.

Today she is a millionaire and has her own company called Finally, cryptocurrencies are available.

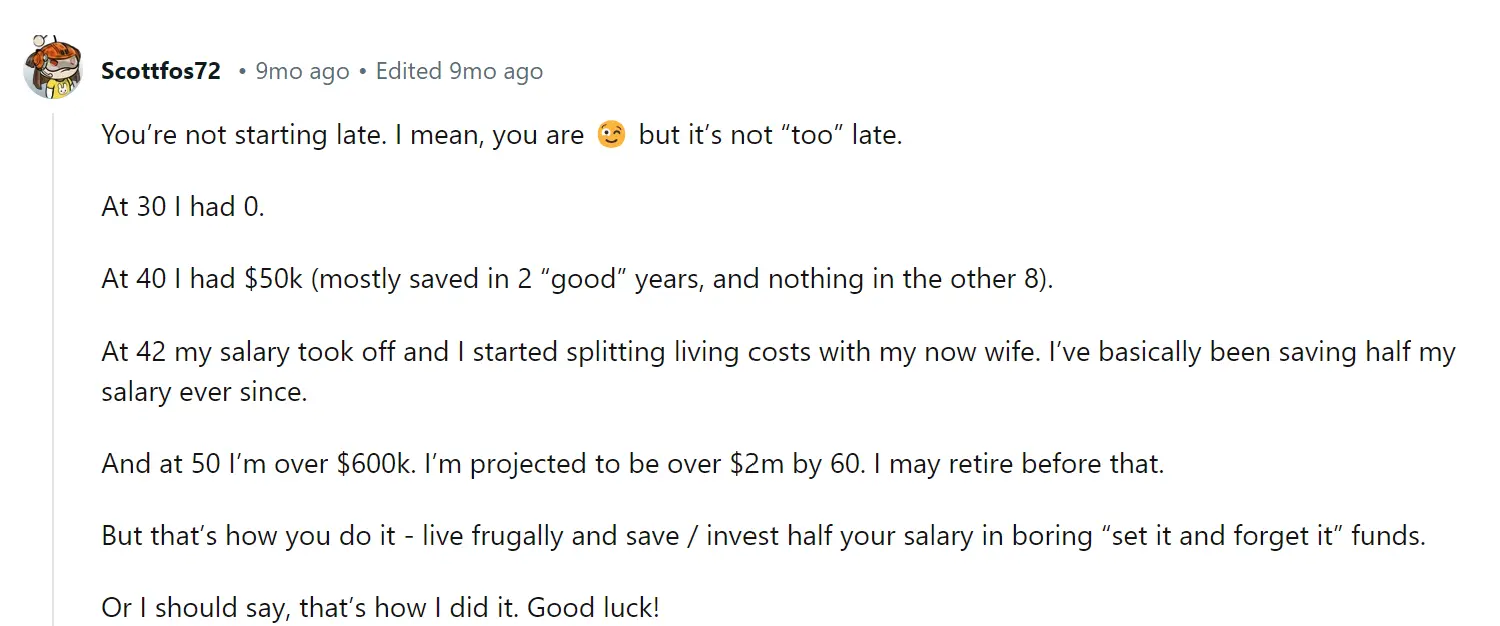

Let’s look at another example here of how starting to save at age 30 in multiple long-term “set it and forget it” investments led to early retirement for this Reddit user.

If you’ve been hesitant about starting your investing journey at age 30, thinking it’s too late, hopefully these examples will teach you otherwise.

Frequently Asked Questions

Is it too late to start investing at 30?

- Definitely not! Starting at 30 gives you plenty of time to take advantage of compound interest and market growth.

What are the best investment options for someone starting out in their 30s?

- If you’re just starting out, start slow with a diversified plan. Including ETFs, index funds, Bitcoin, and bonds. You can work your way up to stocks, real estate, and other commodities as your money grows.

How much should I invest when I start at 30?

- From some of the success stories we’ve shared in this post, you can see that you don’t need much to get started. All you need is to be consistent. Start budgeting and set aside an amount that you feel comfortable investing each week or each month.

It’s never too late to start building a secure financial future.

Starting to invest at age 30 gives you significant benefits and the potential for long-term gains.

The earlier you start, the more you can benefit from the power of compound interest and market growth.

So, if you’re wondering, “Is it too late to start investing at 30?” the answer is no!